By David Shakirov

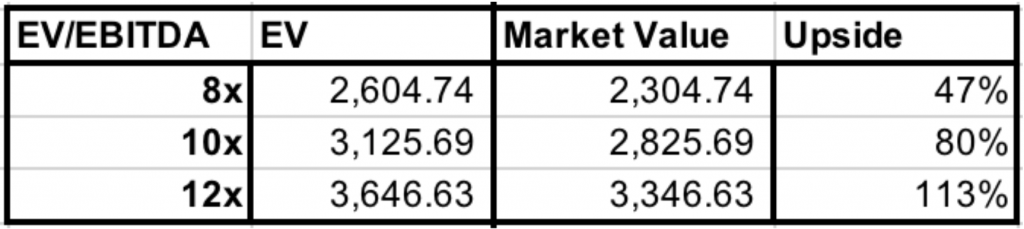

UPDATE (03/26/2020): After a smashingly lucrative three day run (a 50% GAIN), the author recommends selling SDC stock. Though long term fundamentals are strong, the stock’s takeoff of 50% since the recommendation places it ABOVE the 8x EV/EBITDA target of 2025. At this valuation, the risk return profile on the company is unattractive. Here is an updated projected returns chart from the stock price as of this writing ($6.37). I recommend booking these gains of 49.5%, or 39% above the S&P 500, now.

\\\———————————————————————————————————————————///

\\\———————————————————————————————————————————///

ARTICLE:

SmileDirectClub (SDC) is tired of $7,000 braces and exorbitant smile correction treatments. The founders, both millennials, claim that there is a massive opportunity for disruption in a market dominated by Align Technology’s Invisalign and traditional metal braces. Though 85% of the world suffers from malocclusion, these two products have monopolized the market for treatment. SDC offers a streamlined product with the same treatment as Invisalign, but with no extra middlemen. Rather than spend close to five figures on treatment, SDC charges roughly $1900 for their clear aligners via a mail-in teeth impressions kit, or a visit to one of their stores. 65% of people finance their SDC experience via SmilePay, which effectively charges an APY of 17%. Like Invisalign and braces, SDC can request insurers reimburse patients for a portion of the service. Over the last five years, the service has become popularized by celebrity endorsements on Instagram and a consumer-friendly image, growing their revenues from $146M in 2017 to $750M in 2019. The company guidance for 2020 is above $1B in sales.

SDC’s pitch to investors was well received as the stock rose nicely the week after its IPO. Since then, however, the price fell from $20 to $4 as Coronavirus fears and earnings misses handicapped confidence. Though general market sentiment seems pessimistic, SDC is poised to grow dramatically in the next few years, achieve profitability, and trade at expanded multiples. The Coronavirus fear provides an attractive discount to the intrinsic value of the company, which is poised to grow for a number of reasons:

- It promises to expand into geographies acrossthe globe, aiming for 10-20% growth domestically and 30% growth internationally. The company claims it is currently tapped into only 1% of the malocclusion market. Internationally, SDC is expanding into developed geographies similar to the US, like Australia, NZ, and the UK. The company sees roughly 500M potential customers, which translates into an $800B market (at $1700 ARPU). Transposing its experience growing in the US will prove beneficial during its international expansion.

- Domestically, SDC’s strategy is two fold. First, it plans on tapping into a younger market via targeted advertising for parents and young adults. Teens make up two-thirds of the smile-correction market, yet only 5% of SDC customers. This is a massive market opportunity that SDC is targeting by convincing parents that its less traditional alternative is comparable to the pricier Invisalign or more traditional metal scaffold. The second domestic pillar is operational leverage and increased cost efficiencies. Via higher volumes through its stores (which operate at a suboptimal 25% capacity) and wholesale partnerships with CVS and Walmart, SDC claims that significant operating leverage and lower customer acquisition costs (CAC) will drive profitability in 2021 and beyond.

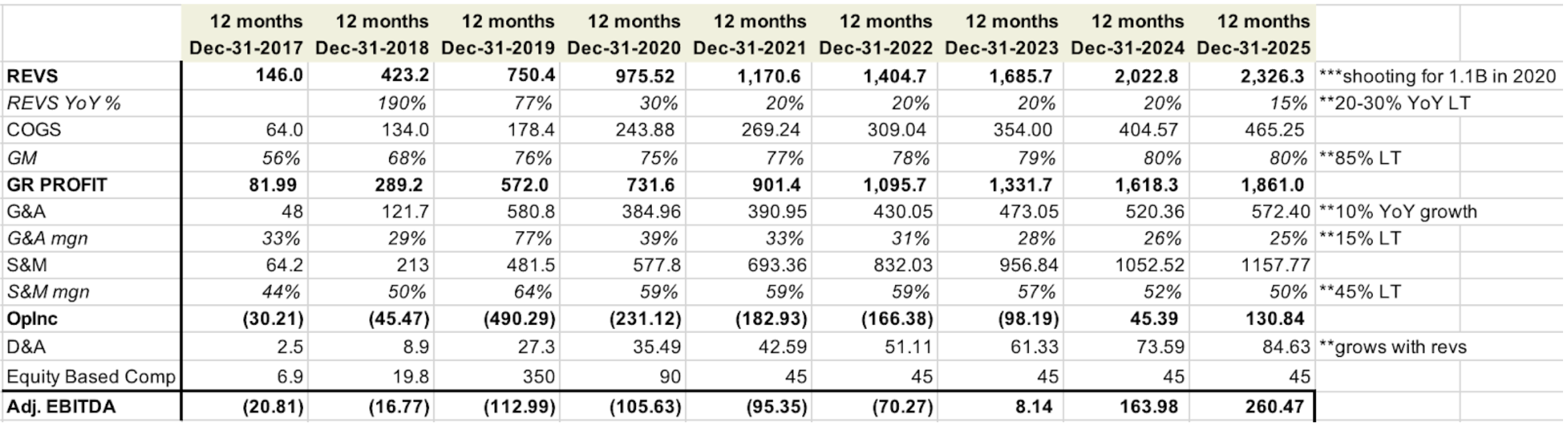

- Focusing on back-end cost efficiencies should also improve all margin profiles. Gross margins are expected to reach 85% since all manufacturing is done in-house, as of 2019. The GM has climbed from 56% in 2017 to 76% in 2019. G&A costs, which were 77% of revenues (or 44% withoutstock based comp), are forecasted to decline to a long term goal of 15%. SDC claims back end efficiencies and “rightsizing” headcount should improve these margins, though I am skeptical that costs will decline to 15% of revenues (more on this later).

Recurring revenues will also begin to play a role as SDC customers purchase retainers and oral care products from the company every six months to maintain their corrected smile. These recurring revenues are now 3.4% of revenues, compared to 0.8% in 2017, and will continue to expand as the base of “treated” customers swells.

Digging deeper into the financials, we see SDC is well-positioned from a capital standpoint. It carries $300M in cash, $200M of long term debt, and access to a $500M credit facility from J.P. Morgan, with an option for an extra $250M. The shares trade at $4 and carry $3.16 of tangible book value per share, which limits some downside on the stock.

Though management is confident in its optimistic guidance, concrete plans are left undisclosed. The model below showcases a conservative take on management’s guidance. Rather than assuming 20-30% top line growth rates from the domestic teen expansion and international scaling as SDC claims, we can assume 20% growth in 2021 that tapers off to 15% in 2025. The gross margins, though estimated to improve from 76% to 85%, may be closer to 80% as the volume-driven ramp up may experience manufacturing headwinds (like in Q4 2019, though management promises these issues are addressed). In terms of G&A costs, the loosest part of management’s narratives, those are modeled to decline to 25% of revenues (versus management’s aggressive claim of 15%). Sales and marketing costs, which are vital to the business, grow slightly under projected revenue growth, achieving a conservative margin (1000bp worse than management’s prediction).

Given 2025 adjusted EBITDA, we can attach conservative multiples to the growth company of 10, 12, and 14x (note its competitor, Align Tech, trades at an impressive 17x). Assuming 300M of capital is used (cash or debt) up to 2025, we back into the following equity valuations and upsides from the current market price.

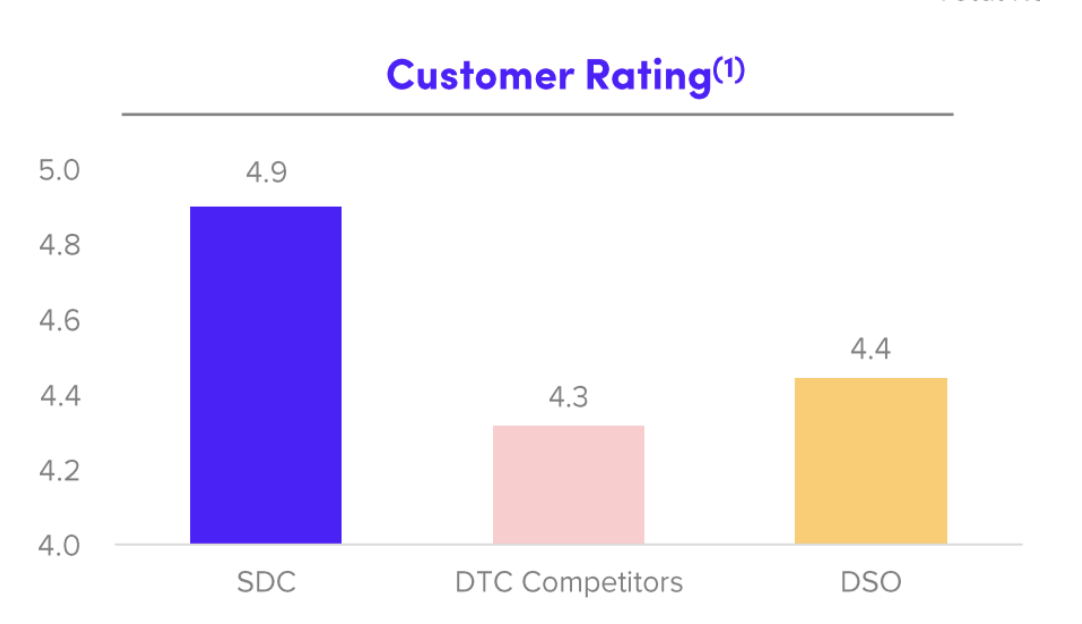

SDC’s stock took a dive for two main reasons. First, it disappointed investors with last quarter’s results, which were below guidance as the company could not keep up with demand in its manufacturing facilities. Secondly, the Coronavirus slammed most equities. SDC closed most of its stores worldwide, though anyone could still begin their treatment via their website. Last week, SmileDirectClub offered their 3D printing facilities to manufacture medical supplies for the Coronavirus crisis. Could a company with a 95% satisfaction rating of its plastic retainers live up to the arduous demands of Uncle Sam? Maybe. But when this virus too shall pass, SDC’s equity will begin to trade more like a promising growth story than a distressed plastics manufacturer.