By Stephen Kletscher

Summary

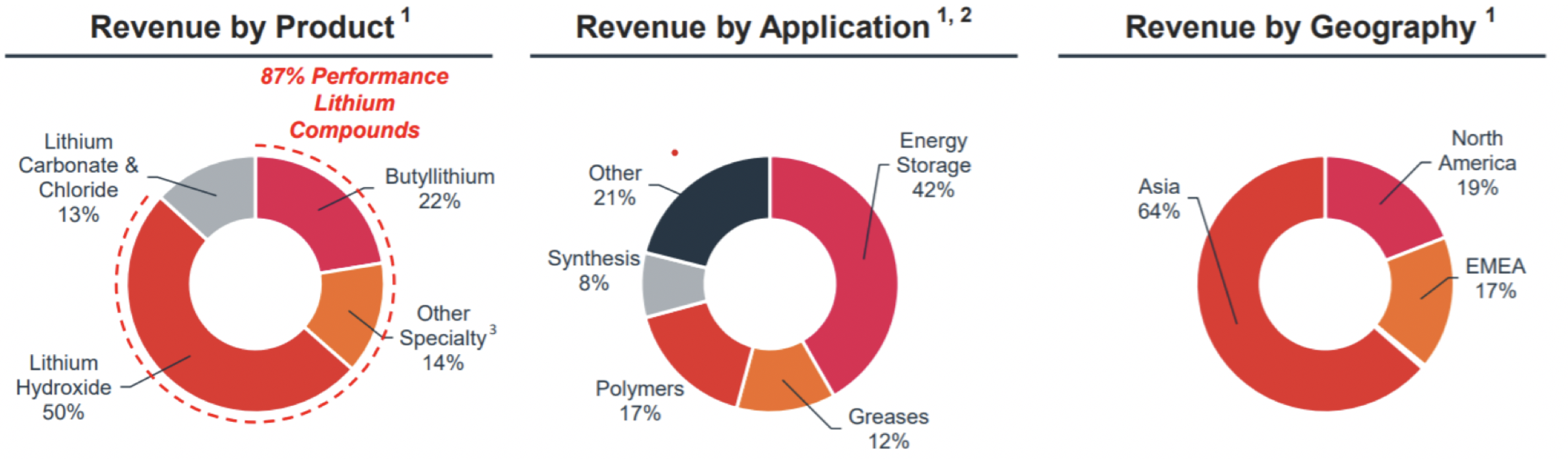

Livent is a lithium producer headquartered in the United States with production facilities in Argentina. Livent both extracts raw lithium materials and manufactures lithium compounds with over 60 years of experience in lithium compound production. It produces and distributes applications in batteries, agro-chemicals, greases, polymers, and various industrial applications. Livent has high revenue exposure to Asia (64%) with smaller exposure to North America (19%) and EMEA (17%). On October 12th of 2018, Livent Corporation spun-off of its parent company FMC Corporation, an S&P 500 component company. Livent generates $388 million in revenue and has a market capitalization of approximately $724 million, making it the largest pure play lithium producer in the United States.

Competitors: SQM, Albemarle

Investment Thesis

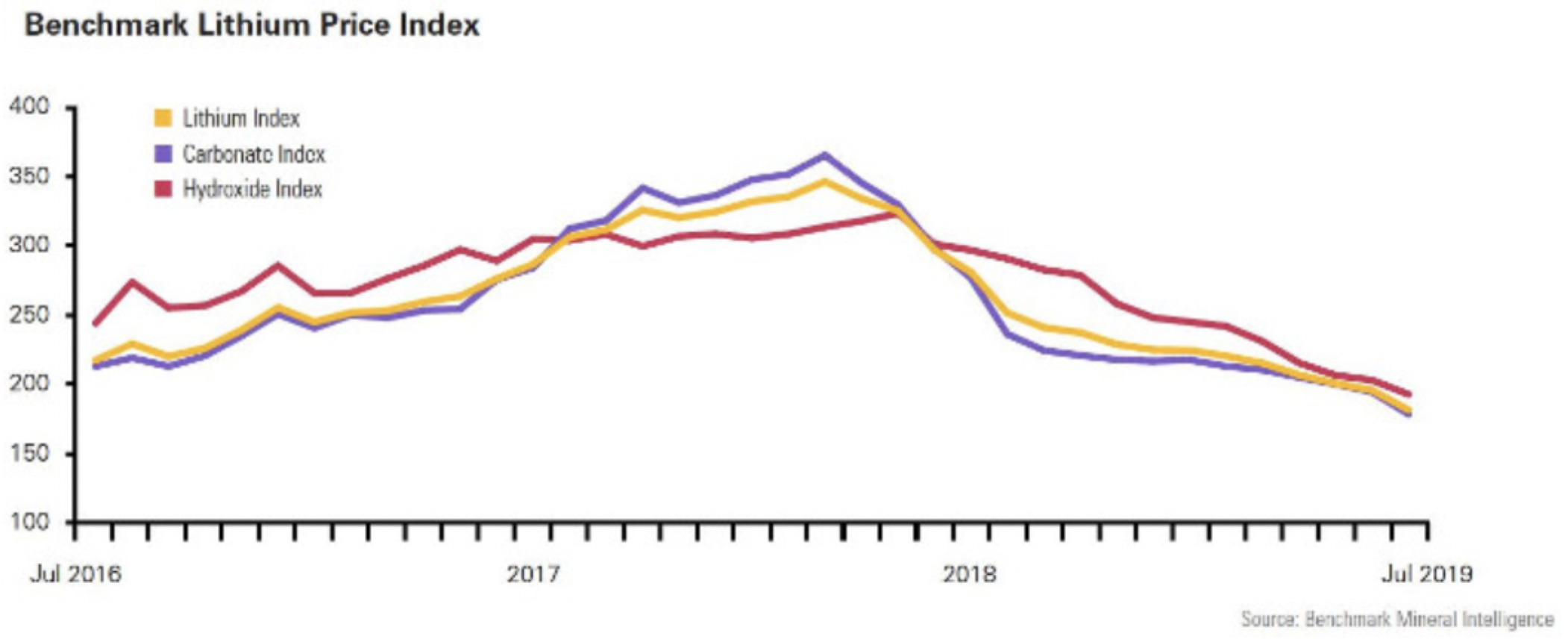

As of March 22nd 2020, Livent Corporation is trading at a cost of $4.95 per share. The price has declined 61.69% in the last year. Livent has a cheap valuation due to recent hard times in the lithium industry. It currently has an EV/EBITDA of 9.38, which is lower than slower-growth competitors SQM (14.66) and ALB (10.09). Sentiment towards future lithium production has grown negative over the past few months due to concerns about oversupply. Many of the major producers of lithium are ramping up supply to meet anticipated demand. Still, there is not enough investment in the space to keep up with long-term demand. Demand is expected to outpace supply by the end of 2021, which should increase prices or keep them stable. Livent can then drive continued EBITDA growth purely through volume.

Livent has a very advantageous market position. It is the lowest cost producer of both lithium carbonate and hydroxide. Livent extracts lithium compounds from its brine operations in Salar del Hombre Muerto in Argentina. Brine extraction for lithium compounds is much less costly than extraction from hard rock such as other producers use. Most new production sites from other companies are hard rock extraction sites, which are significantly more costly. Livent is the lowest cost lithium producer on the market with an EBITDA margin of 20.62%.

Livent has a moat in that it is difficult for new companies to enter the lithium business. It takes an enormous amount of investment to mine a new location. The technology to produce lithium is costly and complex with long time horizons to establish expertise in producing compounds and developing customer relationships. Livent has been in the lithium production business for over 60 years and generates more than 60% of its revenue from customers it has had relationships with for over 2 years.

Livent also has the advantage of a truly global footprint with 7 manufacturing sites across 4 continents. It is one of two companies to produce lithium hydroxide in multiple countries. Lithium hydroxide is used in the production of electric vehicles, so spreading out production in multiple countries helps Livent capture a high future growth area for lithium products. Because Livent already has manufacturing facilities in place across multiple countries, it has an advantage in providing supply as manufacturing capacity catches up with demand. Livent is the only producer of high purity lithium metal in the Western Hemisphere. Because high purity lithium metal is often used US military applications, Livent has an advantageous position in obtaining lucrative government military contracts.

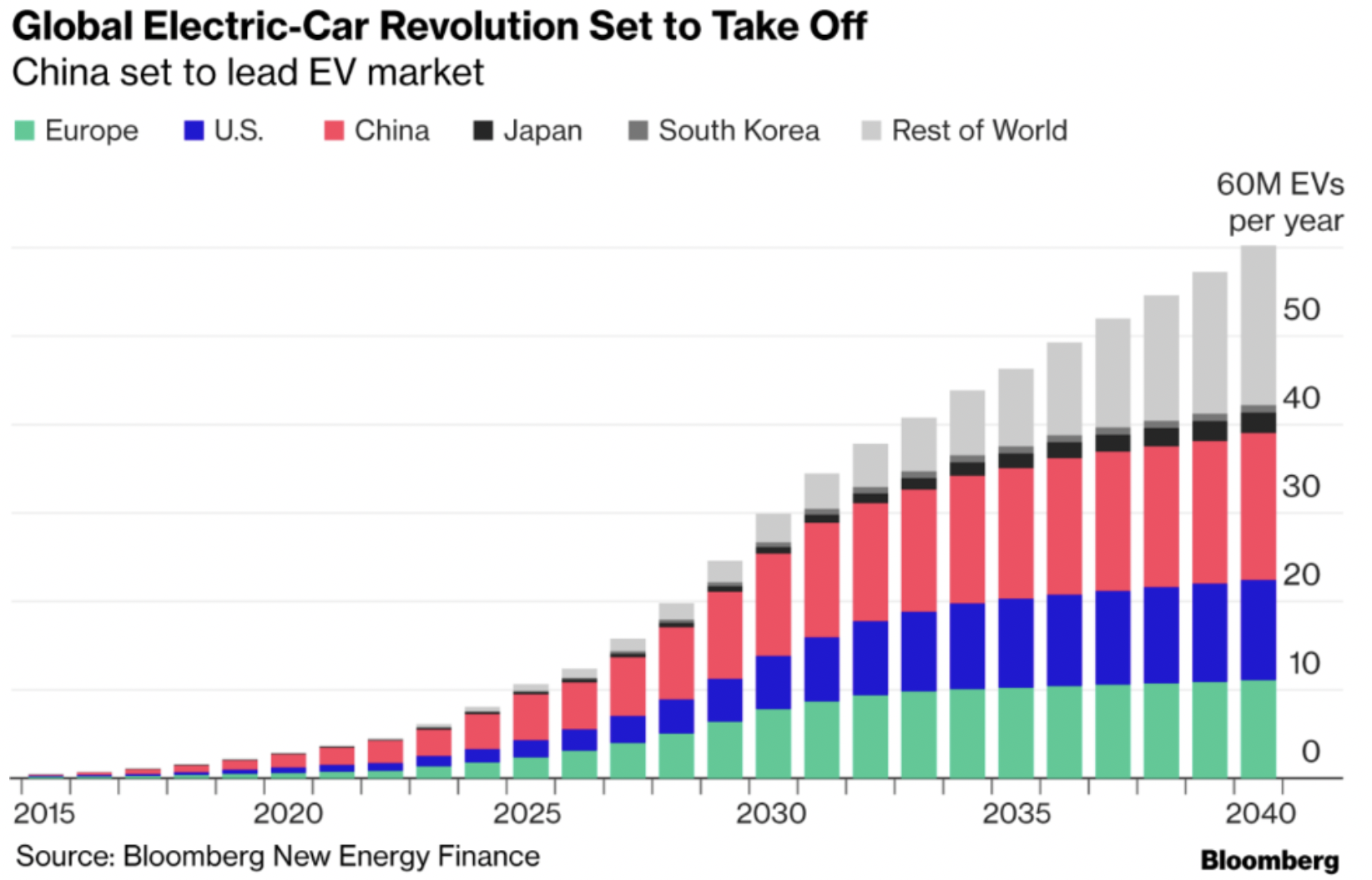

Lithium demand is expected to increase exponentially in the next 10 years. Because lithium is used in electric vehicle batteries, demand for lithium will soar as electric vehicles become more popular. Livent is one of a small number of major suppliers of lithium hydroxide for EV applications. It is focusing on building relationships across the EV supply chain to obtain maximum market share. Sales of electric vehicles are expected to skyrocket in the next ten years, particularly with electric vehicle subsidies in Asian nations. Asia accounts for 64% of Livent’s revenue, so it is a very important market to have these kinds of subsidies for. EV sales are projected to grow at a 32% CAGR through 2027, reaching 19.6 million vehicles in annual sales volume. Due in large part to increased electric vehicle production, Lithium has an expected CAGR of 22% from 2020-2025. Increased production of electric vehicles will result in a large increase in lithium demand that Livent is well positioned to supply.

Livent has plans to heavily increase production in the future. It plans to triple production by 2025 through continued development at the low-cost Argentina site. It is also exploring acquiring a new site to help meet future consumer demand. Increased production will improve profit margins as Livent has had to acquire third party lithium supply to meet customer demand for lithium compounds. Livent plans to use operating cash flow to fund organic growth without relying on global credit markets. This will allow Livent to maintain a strong balance sheet, which is particularly important for a company with high exposure to volatile commodity prices. With plans to grow using operating cash flow, Livent should also continue to reduce debt in the future.

However, Livent is well positioned to succeed in any lithium market conditions as it has a stronger balance sheet and lower costs than its competitors. Furthermore, it takes time to develop the manufacturing facilities and build a supply chain with manufacturers of electric vehicles. Livent already has these facilities in place and is a market leader in R&D for high-quality lithium’s uses in batteries.

Investment Risks

Livent is entirely dependent on the price of lithium. Because it is a pure-play lithium producer, it does not have any other businesses to fall back on if lithium demand decreases. EBITA varies wildly depending on production and lithium prices with EBITDA of $171 million in 2018 and $80 in 2019. Commodity prices tend to be much more volatile than stocks, so having high exposure to commodities results in a more volatile business.

Growth in demand for lithium is dependent on increased sales of electric vehicles. EV’s are currently subsidized by Asian governments such as China. China recently reduced its EV subsidies and may continue to do so in the future. Several major customers are delaying new launches of EV’s due to economic uncertainty in China. If a major economic downturn occurs, the rollout of new EV’s will be delayed. Current macroeconomic conditions are poor with the spread of COVID-19. This could impact the demand for lithium, particularly as supply increases in the market.

There is additional risk associated with Livent’s facilities in Argentina. Livent obtains the majority of its product from its operations in Argentina. This exposes it to political and operational risks associated with Argentina in general. Additionally, Livent’s production can be affected by weather. In the beginning of 2019, late rains delayed lithium carbonate production for 3 weeks. The unpredictability of weather causes this investment to be even riskier.

Recommendation

My overall recommendation is to buy Livent Corporation. In the long-term, this company is a very solid buy. Its strong balance sheet and advantageous market positioning should position it well for the future. Additionally, the outlook for lithium demand is very positive in the long term. Livent’s low cost of production and high profit margins combined with its position in an industry growing at a CAGR of 22% make it a profitable growth stock. Recent selling pressure has created a very attractive value play with high growth opportunities. Once the current selling pressure from an unfavorable macro environment has passed, LTHM will begin to trade more like a growth than value stock.