Dear Readers,

Below is a collection of “blurbs” as we call it: brief snapshots and hot takes on a variety of market-related topics. From analyses on Bloomin’ Brands’ role in the restaurant space to the future of mortgage backed securities, we hope our short pieces will provide you with some Insight on the way we’re viewing market movements in the coming months.

Enjoy!

– The Insight Leadership Board

Our Fed-Fueled Outlook for Navigating a V/W/L/U Shaped Recovery

By Maria Chapman and Saamia Khan

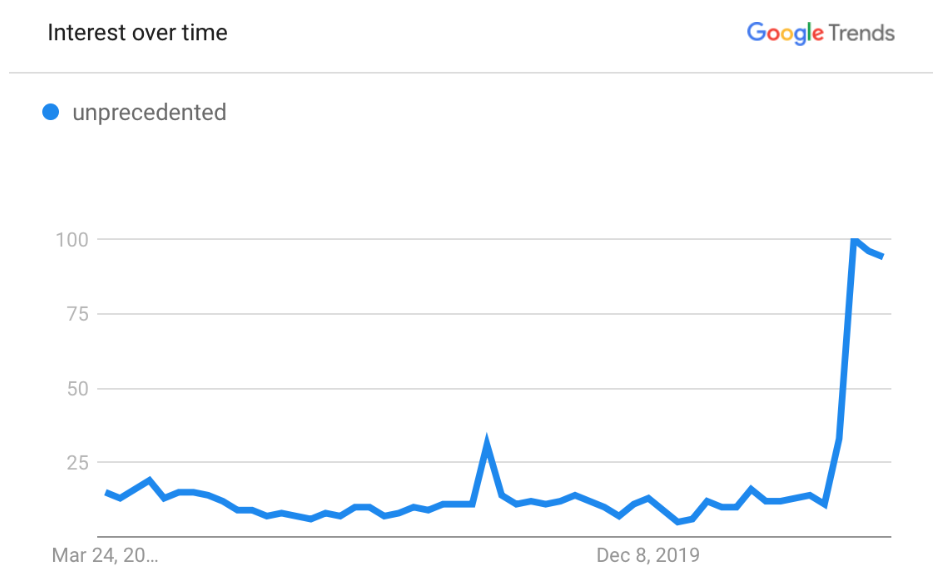

Figure 1: According to Google Trends, use of the word “unprecedented” has skyrocketed since early March, right when the global pandemic forced countries all over the world to go on lockdown

Along with other “unprecedented” situations we’ve seen in the first half of 2020, the Fed has stood out for its extraordinarily unprecedented measures over the last few months in its attempt to triage the effects of Covid-19 on the global economy. In the past few months, we have seen the central bank acting proactively to quell the financial panic that ensued as the U.S. and other countries began lockdown, holding true to its mantra of forward guidance. On March 15, 2020, we saw many of the expected moves: targeting the Fed Funds rate to effectively zero, removing the reserve requirement, declaring a new round of quantitative easing (QE), and encouraging the use of the discount window. The actions that have followed can certainly be categorized as “unprecedented.” The Fed has taken it upon itself to ensure unlimited liquidity in the markets by buying up assets in areas they have never before touched (i.e. municipal bonds, ETFs, individual corporate bonds).

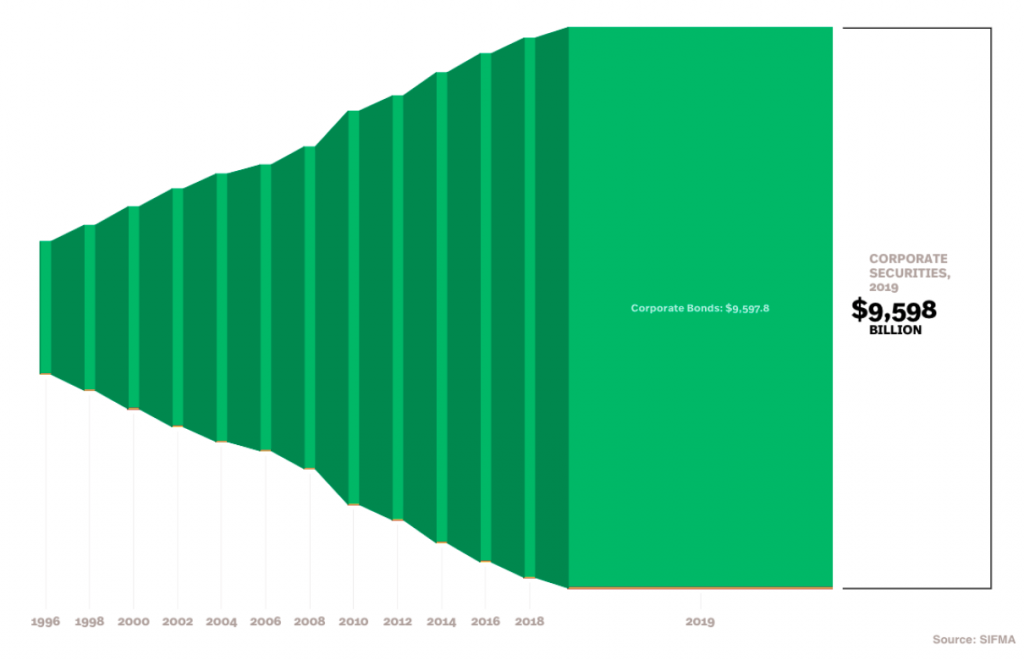

While the Fed has succeeded in making market participants jubilant, we as Insight-ers have had countless conversations about whether or not the market valuations we are seeing are indeed reflective of corporate, and overall economic health. One particular area of concern, as Janet Yellen pointed out on March 30, 2020 during a Brookings Institution video broadcast, are the ever-rising levels of corporate debt. Prior to the coronavirus, a low interest rate environment coupled with investor demand for return encouraged firms to issue massive amounts of debt, often to repay old debt, pay dividends or perform stock buybacks. With companies having to issue even more debt to stay afloat, we could be in for a shock with a surge in company defaults. We are already seeing a massive rise in company bankruptcies.

Figure 2: Corporate debt levels have risen from $5.5T in 2008 to $9.6T in 2019—the Fed’s recent actions in creating a low interest rate environment will only cause this trend to continue

Another foreseeable risk is the illusion of a healthy market as the technology sector outperforms others. The five largest companies in the S&P 500 are in tech and make up about 20% of the market value of the index. Retailers like JC Penney and Pier 1 Imports have filed for bankruptcy while Macy’s (NYSE: M) is down more than 60% since February. Meanwhile, tech giants such as Apple, Amazon, Netflix and Zoom stock have been continuously hitting all-time highs despite the pandemic. Although tech may be the future of our world, the present reality is that the significant performance drops in other sectors such as retail, transportation and travel are affecting the market, even if it’s not always apparent.

We want to emphasize that the Fed has certainly shown that it is more than willing to support the country’s economic recovery through forward guidance. At the same time however, there are inherent risks to striving for a perfect V shaped recovery, risks that should certainly not be overlooked when assessing our market play for summer 2020. Ultimately, we believe no number of stimulus packages nor asset purchases can alleviate the human health-related woes that have inflicted our once strong economy. But shoutout to Jerome Powell for leading us through a volatile first half of 2020 and ensuring liquidity in the markets.

Are MBS-Related Fears Warranted?

By Nathan Szeto

With the recent outbreak of the novel coronavirus, businesses of all kinds have taken to a remote style of work that has resulted in many office buildings being vacated and leases cancelled. Many homeowners, having lost a steady source of income, have found themselves unable to make payments on their mortgages. This situation has led many to question the future prospects of mortgage-backed securities (MBS). More specifically, will MBS cause another financial disaster like that of 2008? The answer is almost certainly no.

First, an important distinction must first be made between agency and non-agency MBS. Essentially, agency MBS are backed by the U.S. government via Freddie Mac and Fannie Mae and constitute 63% of the $11.1 trillion mortgage market as of now. The Fed is currently purchasing MBS and Treasuries at a rate of about $120 billion a month in order to keep the markets running smoothly. Non-agency MBS, aka private-label MBS, are those issued by entities other than Freddie Mac and Fannie Mae and therefore lack the backing of the U.S. government.

Concerns have been raised about non-agency MBS and more specifically the creditworthiness of certain borrowers in what seems to be a situation similar to that of 2008. In fact, ProPublica reports that housing prices have been subject to up to 30% inflation by banks in order to make properties seem more valuable than they actually are. However, what is important to note is that in 2007, there was $2.4 trillion in non-agency MBS, while in 2019 that figures stood at $443 billion. This fact, in addition to the reality that little evidence for the existence of a “housing bubble” exists, leads to the conclusion that even if the non-agency MBS market collapsed, the impact on the economy would not come close to that of the 2008 financial crisis.

One last topic of interest is the awkward position in which mortgage servicers have been placed. The recent CARES Act stimulus package has mandated that all federally-backed mortgages can enter forbearance for a period of one year. While this package is obviously beneficial for homeowners who as a result can continue living in their homes, it puts a great burden on mortgage servicers as they are still expected to make payments to investors for a period of four months after loans become delinquent or enter forbearance. Already at least 7.54% of all mortgages have entered forbearance and that number is expected to grow as the pandemic continues, according to the chief economist at the Mortgage Bankers Association. The increased risk of mortgages has resulted in more stringent regulations for potential borrowers that may persist even beyond the current crisis, according to the economic forecasting firm Oxford Economics. In any case, while the stimulus package does not provide funds to mortgage servicers, loans in forbearance as well as delinquent loans will now be allowed to remain in MBS pools beyond the typical 4 month period. Lastly, to support the functioning of the mortgage market, Fannie Mae and Freddie Mac have been authorized to purchase loans in forbearance according to the Federal Housing Finance Agency.

Flying Blind: Trading Airline Stocks

By Michael Davis

Despite an expected 90% revenue drop for Q2, the airline industry’s stocks have begun to take off, with stocks like American Airlines (AAL) up over 100% from their COVID low. Much like the virus itself, however, the market is fickle. As of today (7/2/20), AAL now sits at $12.50, down 38.5% from a month ago. Now you, dear reader, may be asking: what to do with this volatile yet necessary industry? Short answer: look out for breaking news.

As a whole, the big five stocks in the airline industry are JetBlue (NAS:JBLU), American Airlines (NAS:AAL), Delta (NYSE:DAL), Southwest (NYSE:LUV), and United (NAS:UAL). Within this top five, JetBlue and Southwest standout as the most positive buys. JetBlue has no debt and its EV/EBITDA of 5.29 is well below the transportation industry median of 8.77. Southwest, on the other hand, has a cash-to-debt ratio of .87, well above the transportation industry median of .26 and has a an EV/EBITDA of 5.79, again below the industry median of 8.77. The other three, while larger industry players, all operate with much less cash/more debt and at comparatively worse EV/EBITDA ratios, meaning that while they will stick around, their business models are likely to be impaired for far longer.

As the market stands now, it seems that airline stocks, much like the rest of the market, are handcuffed to any COVID-related news. Vaccine possibility? Look for a rise. Dr. Fauci says there’s an imminent second wave? Look for the fall. After all, air travel is necessary, and as they stand, most airline stocks are probably undervalued. That said, air traffic most likely will not return to its pre-COVID volume for three or more years, meaning that stock movements will be underpinned not by company performance, but by the market’s predictions for the future. The bottom line? Buy with one hand but have the other one ready to sell.

Not-So Bloomin’ Brands?

By Danny Irvine and Chris Bassett

As a result of COVID-19, many firms in the food industry have been hit hard financially from the lack of foot traffic of quarantining and social distancing. Some have fared better than others thus far, with the restaurants already proficient in takeout and delivery such as Domino’s Pizza able to operate more normally than those who offer more of a dine-in experience.

Bloomin’ Brands is a restaurant holding company that owns several American dine-in restaurant chains, including Outback Steakhouse, Fleming’s, Bonefish Grill, and Carrabba’s Italian Grill, typically located in the Northeast. These are higher-end chains, meaning they rely less on takeout as customers prefer the experience of more expensive food in a dine-in restaurant environment. Now, restaurants around the country are starting to open more and more of their locations as social distancing restrictions are lessened. It is unclear how the public will respond at this point in time as fears of the virus may prevent sit-down dining from being as prevalent as before, however there are a few reasons why Bloomin’ Brands may be positioned better than its competitors.

Just prior to the pandemic hitting the US, Bloomin secured a long-term exclusive deal with delivery service, DoorDash, for their Outback Steakhouse brand. The partnership ensures that despite the pandemic, customers can still purchase from Outback, adding an additional component to Bloomin’s revenue stream that their CEO, David Deno, could not have predicted would be especially useful during the proceeding pandemic.

Because Bloomin brands has access to cash, it is more likely to withstand the pandemic. Similar to the majority of companies over the past few months, Bloomin Brands took a loss during the first quarter of 2020 of $34mm, which distinctly contrasts their prepandemic quarterly net income of $65mn. However, over the last few months Bloomin raised $505mm in debt, and after using a portion of that sum to repay some previous borrowings and addressing other financial obligations, they have a $336mn net increase in cash this quarter, which means they have an additional $321mm in cash compared to this time last year. Because their financials were strong prior to the pandemic, they could take on debt to keep their various brands afloat. Bloomin Brands has made between ~$100mm and ~130mm in annual net income each year over the last three years. Therefore, the debt that they took on can be easily paid off over time, once they can safely serve customers in their storefronts again. Thus, although the pandemic wiped out their profitability this quarter, Bloomin brands was able to secure sufficient funding via debt to stay afloat that they can effectively pay down when their normal streams of income return. Notably though, it will take some time to pay down this new debt, meaning that a full recovery for Bloomin looks to be 5-7 years out.

Looking Beyond: A Glimpse into BYND

By Mohammad Mehdi Mojarradi and Michael Bedard

Beyond Meat (BYND) is a rising plant-based food company that went public in Q2 of 2019. BYND’s diversified revenue stream has allowed it to stay afloat during the COVID-19 crisis. Despite 42% of its revenue coming from food services, the hit on restaurants has not had a debilitating effect on BYND unlike some of its competitors, namely Impossible Foods. The company’s primary source of revenue, grocery stores and supermarkets (58%), have been relatively steady. In fact, while BYND reported an adjusted EBITDA loss of $2.1 million in the year-ago period, their Q1 2020 adjusted EBITDA was reported at $12.7 million, despite restaurants getting destroyed as a consequence of COVID-19. Evidently, BYND handled the massive shift in demand from food service to retail adequately. It is important to note that since COVID-19 became a global issue only in the last two weeks of Q1, BYND’s performance in Q1 cannot be viewed entirely in conjunction with COVID-19. However, because it can be for Q2, we believe BYNDs performance in Q2, which has been promising thus far, will be most telling of how the company will emerge from this crisis.

As of March 28th, BYND reported that it has taken adequate steps to ensure liquidity in the wake of the Coronavirus outbreak with roughly $250 million in cash with an outstanding debt of just over $30 million. With their fiscal safety secured, BYND leadership has said that part of their plan is expansion into real-meat territory as several meat processing facilities in the U.S. have large outbreaks. According to Tyson Foods executives, roughly half of the company’s pork processing capability has been halted due to these coronavirus outbreaks in their facilities. As gaps in the market open, BYND hopes to slide in by providing larger-than-normal discounts on their products to big retailers in an attempt to minimize the price difference between their product and beef. Currently pricing their products at around double or triple the price of regular beef products, BYND can stand to make solid territorial and financial gains in the upcoming quarters as they lower prices and become more appealing to the average consumer.

Wrapping Up: Two Cents from Jack Sercu ’22

By Jack Sercu

All, I hope you’re well and staying safe at this time. An economic outlook is intriguing to write at this time, and I think cannot be properly considered without looking at the social change our country is currently going through. I believe we are perfectly positioned as liberal arts students – at an extremely diverse institution – to weigh the various factors and come up with a vision for the future. I will look at two different categories and how they will alter the business environment of the future. First, I will examine the push for ends to systemic racism and injustice. Second, I will look out for when we do rebound from COVID, which is not an exact time period, but more so the year after the country/world opens up again. So, without further ado, my fellow Americans, Jack Sercu’s economic outlook/two cents.

It would be ignorant to speak of the future without looking at how the changing political sentiment in our country will affect business. The resource gap for minorities is completely tied to income – no law in it of itself states that blacks should receive worse education, healthcare or other support. However, due to America’s gut-wrenching history where our systems did prevent certain races from most resources/privileges, these gaps have held pretty steady. Picture doing a 100m race where white people start 50m ahead. Anyways, the wave we have witnessed on social media from a combination of friends and celebrity endorsements is to support minority owned local businesses. I believe reallocating your resources as such is a fantastic way to empower minorities. This will not breakup big business and topple capitalism, but I do believe it will lead to more balance between small and large. Attention to small businesses has increased because of COVID, as many have witnessed their favorite local spots struggling or going out of business and are more aware of their power as consumers… Continued here.