By Saamia Khan

Back in 1998, Lululemon Athletica founder and former CEO Chip Wilson attended a yoga class where inspiration struck. Coining the term “yoga pants,” Wilson created a company based on women’s yet-to-be-discovered need for a comfy pants. Fast forward 20 years, yoga pants and athleisure as a whole have skyrocketed in popularity, reflecting the changing American fashion landscape. In 2014, teens preferred elastic-waistband pants, overtaking the ever-popular pair of jeans. Athleisure as a whole has grown to a massive $167B industry, and will take up an even larger portion of clothing sales as the shift in preferences continues.

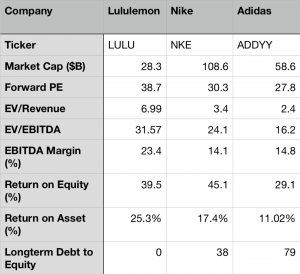

Since its founding in 1998, Lululemon has established a total of 460 stores, mainly in the U.S. and Canada. It has evolved from selling just yoga pants to becoming an icon for all types of athletic wear, outerwear, and shoes (partnering with Athletic Propulsion Lab) for women, men, and girls. Recently, they launched a new line (“Lab”), a high-end streetwear separate brand with a price range of $80-$500 per item. With its $100 leggings feeding into nearly $3.3B of revenue in 2018, LULU stock has been gaining significant traction in the investment world, especially over the past year. With an EPS of $4.51, the stock’s recent high of $229.65 on November 29th is a more than 100% increase since its 52 week low of $110.71.

While recognizing it does not trade cheaply, we believe Lulu is undervalued as the company sets itself apart with its tremendous yet realistic growth opportunities. LULU is a buy.

Three-Pronged Approach for a 5-year plan (“Power of Three”)

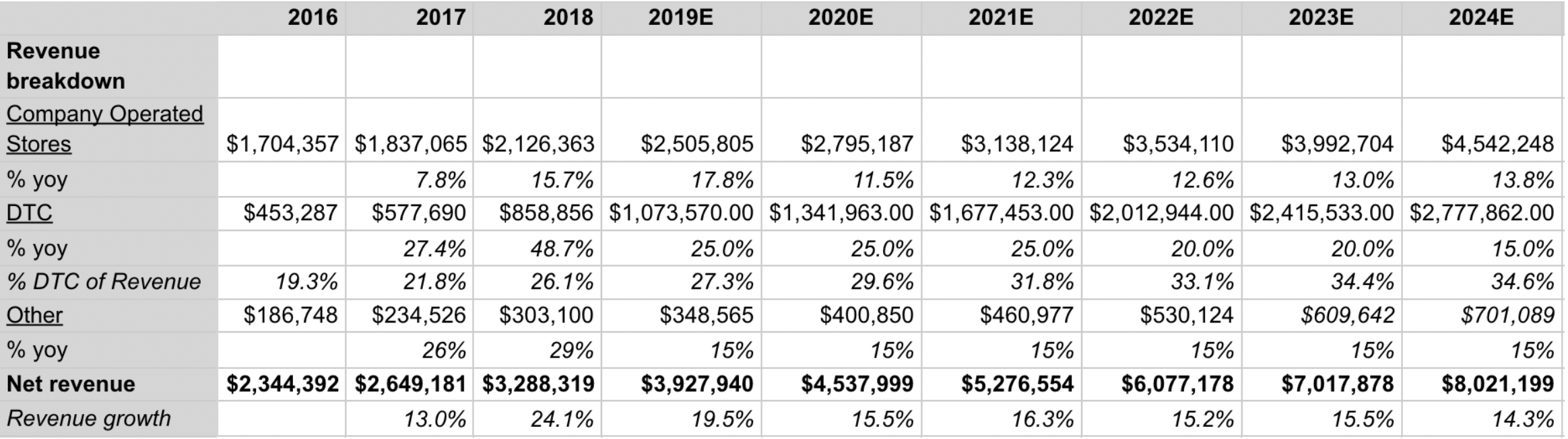

Lululemon has three main target areas that feed into its optimistic mid-teens revenue growth numbers: an expansion into the international arena, increasing menswear sales, and doubling online sales.

1. International Growth:

Lululemon plans to greatly expand in Europe and Asia by 2024. The Asian market is one that Lululemon has yet to crack, and the next 5 years will be an important pivot to a greater global presence. The company currently operates 29 stores in China, and expects to open an additional 55 by 2024. In Europe, Lululemon has 12 stores and aims to open another 40 in the next 5 years. Overall, the company aims to have a total of 670 stores worldwide by 2024, a significant increase from its current 460.

2. Menswear

Though initially catering only to women, Lululemon expanded its offerings to men in 2015. Since its menswear launch, the company has struggled with the issue of being recognized as a dual-gendered brand. However, in recent quarters, the line has kicked off following the launch of their most popular men’s item, the ABC pant. Menswear sales increased by 28% in Q2 2019. The line is poised to continue its expansion in the coming years, and is set to more than double in sales in the next two years with the help of an ambitious marketing strategy. In the words of COO Stuart Haselden: “It’s growing faster than our women’s business.”

3. Online Sales

Lululemon has projected that direct-to-consumer (DTC) sales will at least double by 2024, a reasonable target given the company’s ability to drive online traffic in recent quarters. Online sales were up nearly 50% in the past year. In terms of profitability, online sales eliminate a plethora of costs between manufacturing and delivery to the consumer, hence allowing for margins of over 40%, compared to ~20% with in-store sales. These increased margins will help power overall company margins and offset costs in other areas.

—

In considering this three-pronged approach, it is apparent that Lululemon Athletica is exploring new avenues for revenue growth, having only just commenced its worldwide expansion. We assume a consistent revenue stream for each store opened until 2024 based on current figures. We also expect online sales to continue its growth in the double digits and subscription-based revenue growth of 15% per year (Other). Putting the above three revenue avenues together, we predict that Lululemon is poised for consistent revenue growth in the mid-teens through 2024.

Just a Trend? On Brand Strength and Loyalty.

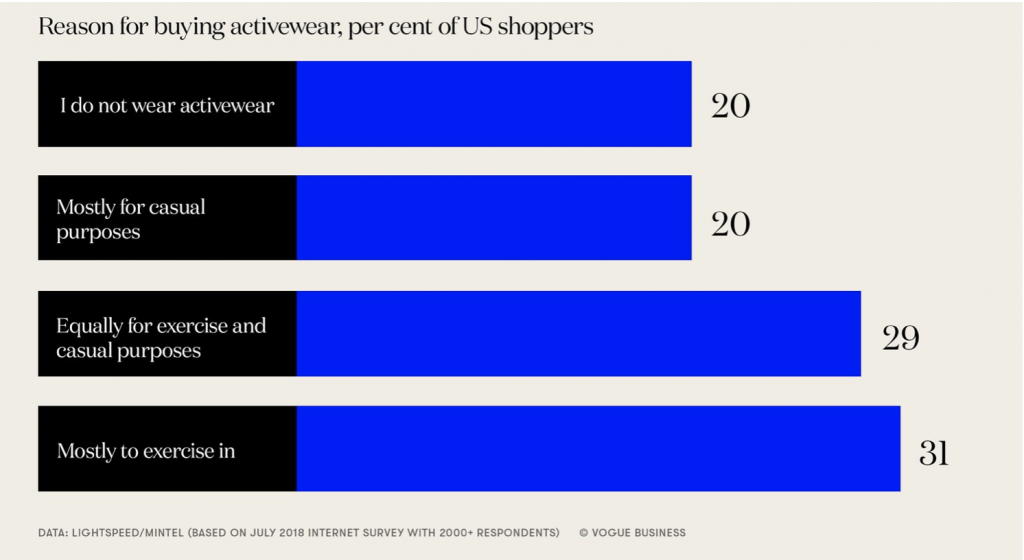

Lululemon’s projected success detailed above is contingent not only on the attraction of its products, but on the general success of the athleisure industry as a whole. There is a general push towards “wellness,” and buying goods that feed into this mindset. In fact, a growing percentage of Americans buy activewear not just for athletic activities, but as everyday wear.

Images from Lululemon’s experiential store in Chicago offering smoothies and yoga classes, reflective of the company’s push to integrate customers into a larger ecosystem.

Moreover, Lululemon has emerged from its position as a mere retailer. It is no longer a brick-and-mortar shop where purchasing athletic gear is the only appeal. First, the Lululemon brand is especially prominent and the name-value brings with it a host of advantages, a feature its customer base is most definitely aware of. The distinct reflective horseshoe logo has become a recognizable symbol of wellness and athleticism. As mentioned above, in addition to in-store and direct-to-consumer sales, a third portion of revenue comes from subscriptions. Lululemon has recently made a large push towards incorporating customers into a greater ecosystem, offering yoga classes and membership to running clubs. Its new paid loyalty program, similar to a program that current Lululemon CEO Calvin McDonald implemented during his tenure as CEO at Sephora, ensures customers return for limited-edition products, free expedited shipping, and other perks. As of Q3 2019, the program has had positive “results [that] have been well above our expectations going in very favorable,” according to McDonald. They have teamed up with SoulCycle to offer custom-made gear, solidifying its name in the high-end athletic space.

From Lululemon’s website: a look into its differentiating technology

Lululemon also sets itself apart due to its technology. The company’s research and development lab within its headquarters, Whitespace, is made up of around 50 employees that include scientists and physiologists. Lululemon’s quality goods contribute to the company’s strong ability to retain customers while demanding a high price point.

Strong Financials

Lululemon has a great balance sheet, especially for a more than 20-year-old company, the main takeaway being that they have no long-term debt. With continued revenue growth and higher margins, we expect cash flow to sustain and reflect in shareholder’s equity.

Comps

In comparison to its largest competitors, Nike and Adidas, Lululemon certainly seems to be the most overvalued. Despite its high EV/Revenue and EV/Revenue numbers, Lululemon’s small market cap in comparison to Nike and Adidas is indicative of its immense growth opportunities. Moreover, its return on asset figure is higher than competitors, an attractive quality for growth valued company.

Risks: A Discussion

I will address a few potential risks to Lululemon’s revenue growth.

Tory Burch’s luxury athletic wear store, Tory Sport, on Fifth Avenue

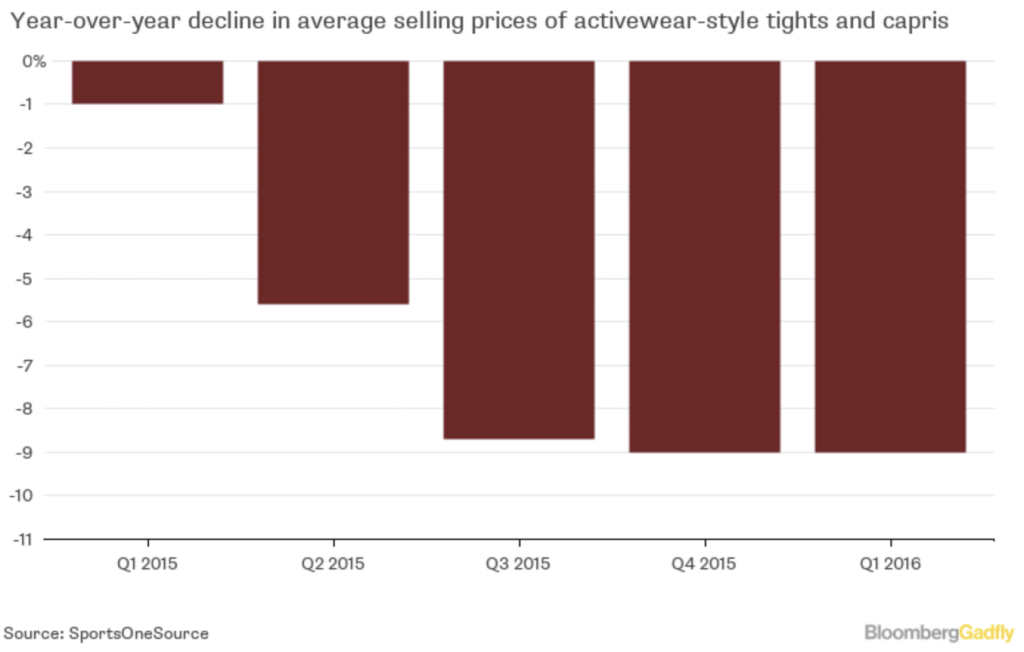

A main worry in the athleisure industry is the low barriers to entry and the resulting competition. Seeing Lululemon’s high margins, it is an attractive industry for outsiders. In recent years, Nike and Adidas have greatly expanded their women’s lines in an effort to compete with Lululemon. Many higher-end names such as Tory Burch alongside streetwear brands such as KITH have also waded into the athleisure space. However, as discussed earlier, Lululemon has and continues to integrate customers into a larger Lulu ecosystem, making Lululemon more than just a retailer. At the same time however, changing preferences and trends could potentially have large impacts on Lulu’s profitability.

Another concern with low barriers to entry is the possibility of a drop in prices of similar goods. For the past few years, Lululemon has been able to sell nearly all of its inventory at no discount, due to a deliberate strategy to lower supply and entice customers. However, in recent quarters, the company’s sale section has been expanding, and many so-called “less-trendy” leggings go for as low as $60. Whether this new pricing strategy feeds Lululemon’s profitability is yet to be determined.

Given the current political climate, the possibility of U.S-China trade tensions affecting profitability is a valid concern. However, in its most recent quarterly report, Lululemon claims that only 6% off its total inventory would be affected by import tariffs; it has recently pushed to diversify its manufacturing bases, and most of which now occurs in Vietnam and Cambodia.

Conclusion

Lululemon Athletica is a company with strong financials and an even stronger growth potential. By tapping into yet-to-be-explored markets, we expect to see Lululemon continue its emergence as a worldwide player. Its unique ability to innovate and dedication to creating quality products coupled with an overall shift towards comfortable clothing will allow Lulu to sustain its high customer retention rates.