By David Shakirov

UPDATE (6/13/19): the author recommends selling Ferrari stock. Currently, shares trade near $160. Given Ferrari’s guidance for 2022, the stock is trading at a 30x P/E on those numbers, or a 50x+ P/E on today’s figures. Macroeconomic headwinds may still push down its equity price in the next 12-18mo, though Ferrari NV’s underlying business will likely not be impacted as severely as most corporations.

Insight readers will book considerable capital gains: since the article’s publishing just 5 months prior, Ferrari stock has climbed 40%, or 31.2% above the S&P 500.

\\\—————————————————————————————————///

In my last article, I spoke about Ford — an international behemoth with revenues of $150B+, low margins, distressed investor sentiment, and production numbers of over 6 million cars per year. Ferrari is also a car company, is publicly traded on the NYSE, and starts with the letter “F”. That’s where the similarities end.

Here’s why Ferrari is so interesting — unlike traditional car companies, Ferrari has immense control over its top line and customers. More specifically, Ferrari admits to limiting production of its vehicles significantly below demand to enforce an aura of exclusivity, luxury, and brand image. The latter, Ferrari admits, is crucial to its business. However, how can a publicly traded company answer to Wall Street’s insatiable appetite for GROWTH? Ferrari’s medium-term solution is to grow its product lines (sports cars, GTs, and Purosangue, or SUV) and expand its demand base significantly, while growing supply at a meager 7-8% per year. In this way, Ferrari essentially controls their top line in the short run. The longer run issue, however, is when will its production finally reach demand, forcing the company to lower prices or lose its brand image? Ferrari’s current

valuation has limited medium term upside (more on this later), but investors may be interested in three factors — high dividend potential (when the company matures in the mid-late 2020s), international growth (in EMs, China, and LatAm), and nearly universal brand value and name recognition.

The relationship between Ferrari and its customers is highly unique. Of its car sales, 65% are to existing Ferrari owners while around 30% are to owners with at least 2 Ferraris. To be “allowed” to buy one, prospective clients are often screened by their devotion to the brand through Ferrari fan-clubs, general passion for the vehicles, financial standing, and other unknown factors. Owning a used Ferrari also helps. Then, customers ate pushed to buy the entry-level variants (such as the California or Portofino). This, combined with its undersupply strategy, could position the company to weather a recession incredibly well— they control who buys the cars, and tons of clients want them! In 2008, when Ferrari was not as prominent in LatAm, EM, China, etc. and did not offer as wide of a lineup, its auto sales slumped 10% (while the luxury performance auto market shrunk in half).

It is possible that in a mild recession, Ferrari’s production may continue to rise as even recessionary demand for its prancing horse declines, given the significant gap between supply and demand.

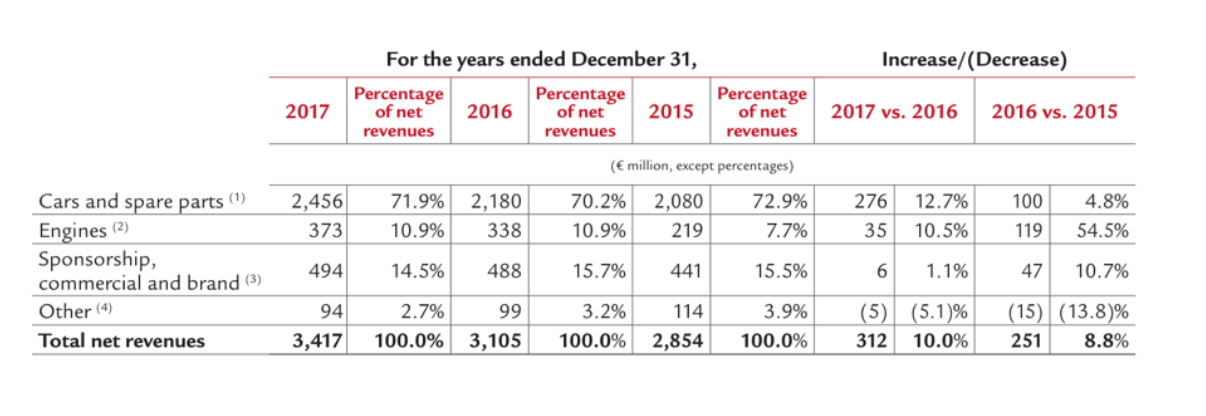

Although Ferrari is known for its car production business, this only accounts for 72% of revenues. Another 11% is engine production for Maserati (which accounts for ~80% of Ferrari’s total engine production, with the rest for Ferrari vehicles). Another 15% percent is purely based on its brand — licensing and distribution fees from selling Ferrari merchandise (think hats, shirts, and Legos), Ferrari World Abu Dhabi, and other brand-related revenues. Capital-wise, Ferrari took advantage of low rates (bonds with 25bp coupons) and secured a number of large bond offerings (it has 1.8B Euros of debt on the balance sheet, and runs net debt). Given its high margins, ability to refinance, and strong top/bottom line growth, the debt likely does not pose a significant risk to the business.

There are other important risks, however. First, international emissions regulations are pushing Ferrari into two directions. The brand could either keep buying emissions credits (by paying “clean” companies like Tesla, given Ferrari’s twelve-cylinder gas-guzzling sports cars) or begin improving efficiency. The latter strategy, which is realistic into the future, would involve hybrid motors and electrification (both of which Ferrari is trying to avoid as to not damage its brand reputation for gas-motor sports cars). Ferrari promises that in the next 3-4 years, 60% of its lineup will encompass hybrid tech and that these models will stay true to their Italian high-performance roots. Competitive risks also exist, from brands like Lamborghini, Aston Martin, Bentley, and Rolls Royce. Most of the competition is also backed by larger auto companies (Volkswagen Group in the case of Bentley and Lamborghini, BMW for Rolls Royce, etc.), which Ferrari had until its spin off and IPO in 2014. The benefits of this include better bargaining power, platform sharing, lower costs, etc. (for example, the new Lambo SUV is on the same platform as Audi’s Q7, also owned by Volkswagen). Additionally, given that 77% of Ferrari’s sales are of its lower-end V8-engine cars (which have an MSRP of $200-300,000), competition at these price points is higher. This may further discount the value of the Ferrari brand, as clients may be inclined to purchase competitive vehicles (either for lower-price or better quality). As Ferrari increases its production numbers beyond competitors due to its publicly-traded nature, it may also lose its exclusivity and touch with customers (this may not be an issue, however, if the company expands into different categories like hybrids and SUVs).

Through a DCF, I considered three cases — a base case ($116 target) where company guidance through 2022 is generally met (see the “Key Financial Targets” table), a bear case ($97 target) which includes a recession, and a bull case ($127 target) where company guidance is generally met two years early. The base case assumes a 4.7% annual growth rate of the core vehicle business (based on the CARG of the last 5 years), a 10% annual increase in Maserati’s engine demand (based on Maserati’s growth goals), and a 3% annual increase in the sponsorship arm (conservative growth). The bull case assumes the same 4.7% growth rate (since a “bull” scenario does not mean more production, given Ferrari’s exclusivity model) of the core business, but a stronger 20% y/y growth of the Maserati engine business, and slightly higher growth for the sponsorship business (somewhat conservative 5% per annum). Finally, the bear case assumes zero growth for the core business (not a decline, however, since Ferrari’s market is quite undersupplied), a 25% decline in Maserati’s business (based on luxury auto market behavior in 2008 from competitors like Mercedes/BMW), and a 20% decline in sponsorship (given a 15% decline in retail sales in 2008).

As you can see for yourself, there is not much upside or downside in the stock. However, given that they directly control around 70% of their top line results by controlling supply, the company’s performance has little downside in a recession. The short to medium term upside, however, is weak as well. Maybe I should have written this article two years ago, when Ferrari was trading at $40 (and not $110!) and had similar fundamentals. If you already own the stock (and don’t want to realize your gains for tax purposes), or are looking to invest longer term, there are a number of reasons to stay in. First, the company promises to buy back ~10% of its market cap over the next 2-3 years, has long term growth opportunities in markets like LatAm, China (where they sold only 617 cars in 2017), and other EMs, especially if it will expand its line-up to include hybrids and SUV-like vehicles. Its incredible brand value doesn’t hurt as well, while the prospect of a cash-cow business opens up the opportunity for high dividends (which are strongly considered by management for before 2022).

Overall, Ferrari is an exciting company. Unlike most car companies, it has immense control over its customers and makes exciting products. I live only a couple miles away from Ferrari’s North American headquarters and had a chance to chat with some of their engineers. One told me that Ferrari’s engineering and designing prowess (in terms of features and reliability) has improved drastically from just 3-4 years prior. Surprisingly, only two years ago, most car journalists weren’t excited about Ferrari’s vehicles and presumed that the company was relying too much on their brand to sell their cars. As a car enthusiast, I checked out the new Portofino, 812 Superfast, and some of their future offerings — Ferrari has massively stepped up products. The auto world agrees.

And who knows, maybe by buying Ferrari stock for growth you’ll be able to purchase one of their heart-stopping, pants-dropping cars down the road. If they’ll let you, that is.