By Nilay Neelaveni

In this article, I will be covering General Mills (GIS), a consumer food manufacturer and marketer. Its many well-known brands include Annie’s Homegrown, Yoplait, Pillsbury, and Cheerios.

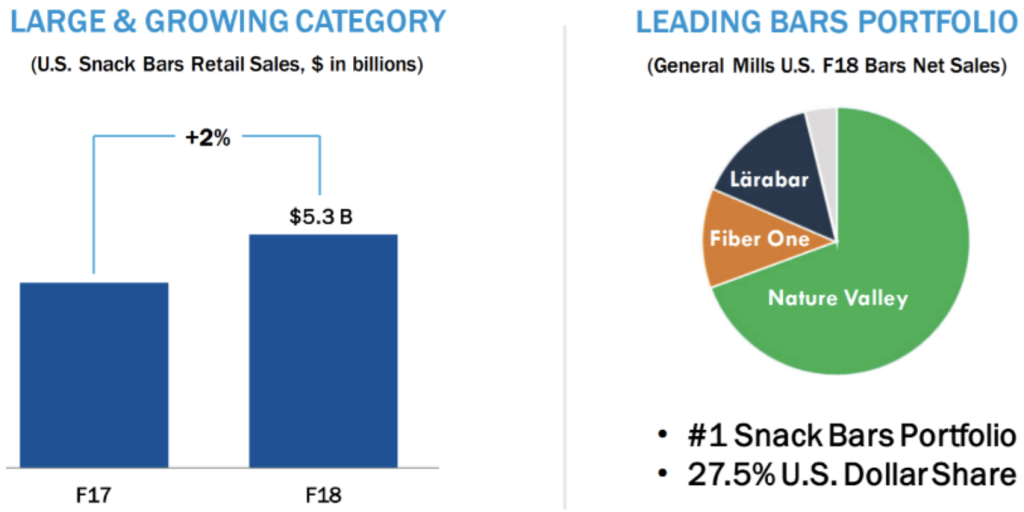

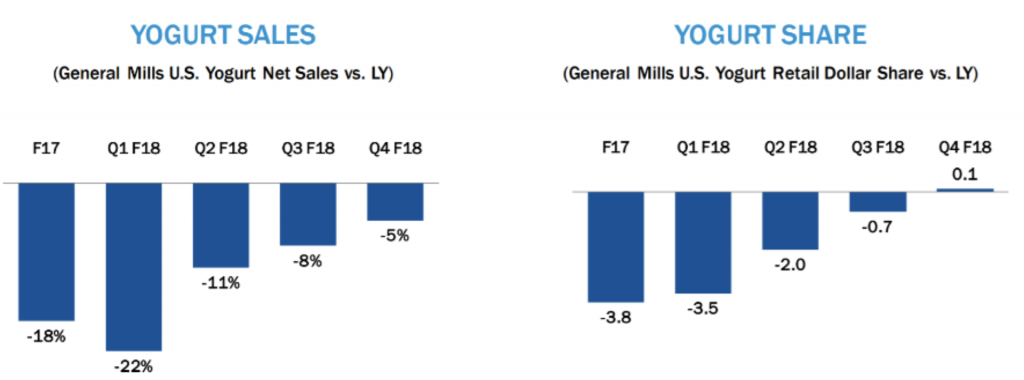

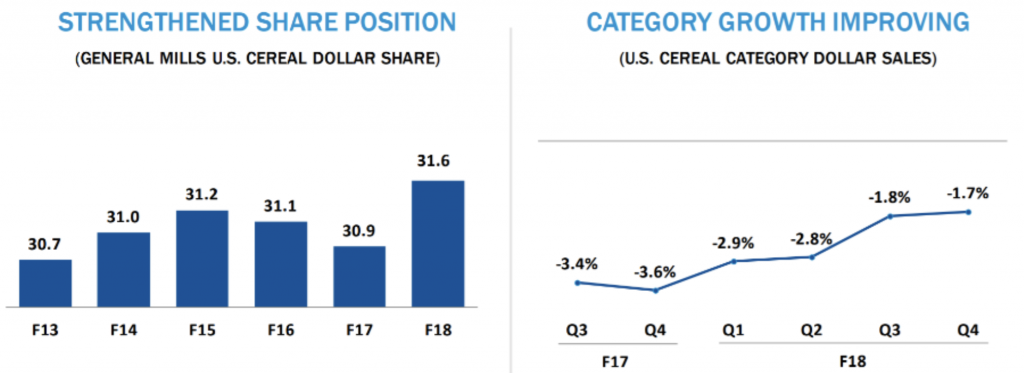

From 2018-2019, net sales changes were characterized by cereal’s flat performance, yogurt’s 2% dip, and snack’s 4% drop (GIS’s main business segments). The growth driving capabilities mentioned in the investor presentations—improving packaging and pricing, innovating products, improving e-commerce (i.e. Boxtops), building more sponsorships, and increasing media coverage – provided reasons for optimism. Apart from GIS’s main products, it also started pushing more BLUE pet food, an area with lots of potential for growth because of the expanding market. Q3 2019 displayed flat growth in net sales of GIS’ main products like cereal (677.1 to 685.5 million), yogurt (514.8 to 495.2 million), and snacks (887.9 to 869.4 million). Pet net sales, however, grew approximately 458% (14.5 million to 80.9 million), which is a mix of investment and true organic growth. While net sales barely grew, GIS estimates that its net sales will grow 9 to 10% from the current $15.7 billion based on the investor presentation. Also important is that EPS also grew from .66 to .86 per share, indicating better financial health. Though it may seem like GIS’s main products are going nowhere, a glimpse into the slight upward trend of its market share and its main business segment sales, combined with the initiatives described above are promising.

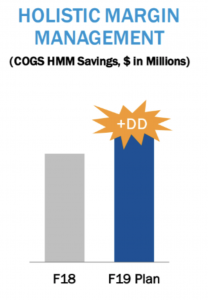

Though it may take some time for these sales to grow, GIS is knee deep in cost savings programs that are estimated to increase savings in 2019 according to their investor presentation. The positive trend of its food groups and increased savings means this company still has so much potential to grow with regards to growth in revenues and minimizing costs.

It is first important to note the EV/EBITDA also increased from 11.7x (2018) to 12.5x (2019). EBITDA has remained flat from 2018 to 2019 while EV has increased by about 10% from 420.3 to 460.0 million. In addition, the massive debt on this large company should not be a worry since the interest coverage ratio of 12.56x means this large cap company can cover its interest payments. On top of all this, strategic revenue management has helped increase operating profit margins to 18% from 16%. Furthermore, because the EPS has increased, dividend yield can remain at a 3.60%, which is the highest of its competitors.

This company has its sail set in the right direction as we have seen by the promising changes in GIS’s business model. As the revenue grows and costs decline, the net income and profits will grow significantly, which can translate into the share price. If these signs hold true, I believe this company is a buy.