By Lily Warendorf

Despite naming every blatantly obvious attribute of their company, Peloton lacks one significant attribute: profitability. Although not being profitable does not raise red flags for investors in high growth companies like Peloton, it’s unclear path to profitability leads us to short Peloton. While Peloton’s subscribers think they are riding into the future, the company itself does not appear to be heading that way.

How Peloton Works:

Peloton is an interactive fitness company. They sell treadmills and stationary bikes attached with a screen that plays a live fitness class while you are working out. It is similar to a Soul Cycle class with high energy and loud music, but in the comfort of your own home. The products themselves are not cheap with the bike costing $2,245 and the treadmill $4,295. However, expenses don’t stop there. In order to even access the live classes (the distinguishing feature which makes this company unique) you have to pay an additional $39 a month to access every live and on-demand class on your devices. However, if these expenses seem too high, Peloton has released an app that requires a monthly fee of $12.99 that includes live exercise classes such as yoga, running, cycling, and strength from your device. The app is separate from the membership and does not require ownership of any Peloton machines.

Risks:

It is true that those who own a Peloton will most likely speak positively about their fitness experience with the company, the high prices are hindering the company from the massive growth they talk about. The high price may result in a limited addressable market for the product and consumers instead would use a bike at Planet Fitness for $10 a month or go to a cycling class. Although one Soul Cycle class is relatively expensive and can range anywhere from $30-$40, it is much less financially binding than a Peloton machine. You could buy around 64 Soul Cycle classes for the price of one Peloton bike. While the payment on a Peloton would allow for unlimited rides, 64 rides is a lot and there is a good possibility either you could become uninterested in cycling within that period or you could prefer the classes in studio as opposed to riding alone at home. All things considered, the price of the products deter a lot of potential consumers and will ultimately cause growth to slow. While I do believe having a Peloton would be convenient, as a consumer in the industry, I see the alternatives as a better option.

The potential for Peloton to overestimate the rate of growth is important as they have overestimated anticipated sales for the December and January quarter much higher than the estimates of analysts. Peloton expects sales between $410 and $420 million in December in contrast to analysts’ expectation of $385 million. Peloton expects around $1.5 billion of sales in January, while analysts expect $1.35 billion. It is valid to say that Peloton might be a little too optimistic about their performance.

Peloton is also facing a $300m lawsuit against around 1,000 unlicensed songs. They are accused of using music producers’ songs without having synchronization licenses. After the lawsuit, customers have been complaining of the music quality. If music quality is an area of weakness for the company, the lack of music can pose a risk to sales, as the music and interactive aspect of the company is what makes it unique. When fewer people want to use Peloton to work out, less people will buy or subscribe, and again growth will slow.

Financials:

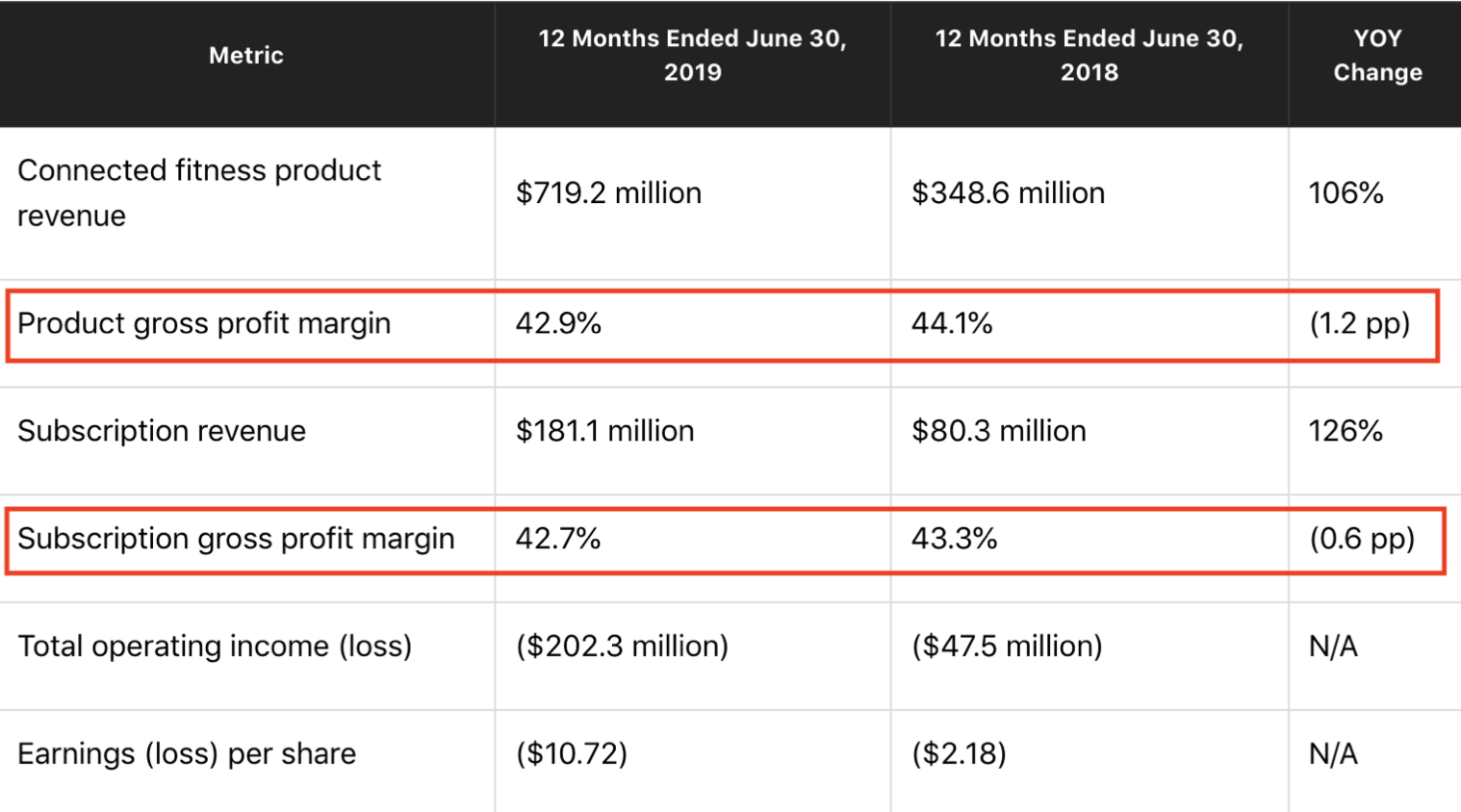

Peloton’s revenue is not a problem. It is increasing substantially year over year. It is the declining gross profit margins that raise concern. Both the product and subscription profit margins are decreasing. The product gross profit margin declined from 44.1% to 42.9% from 2018 to 2019 and the subscription gross profit margin decreased from 43.3% in 2018 to 42.7% in 2019. These declining gross profit margins raise a large concern about future profitability.

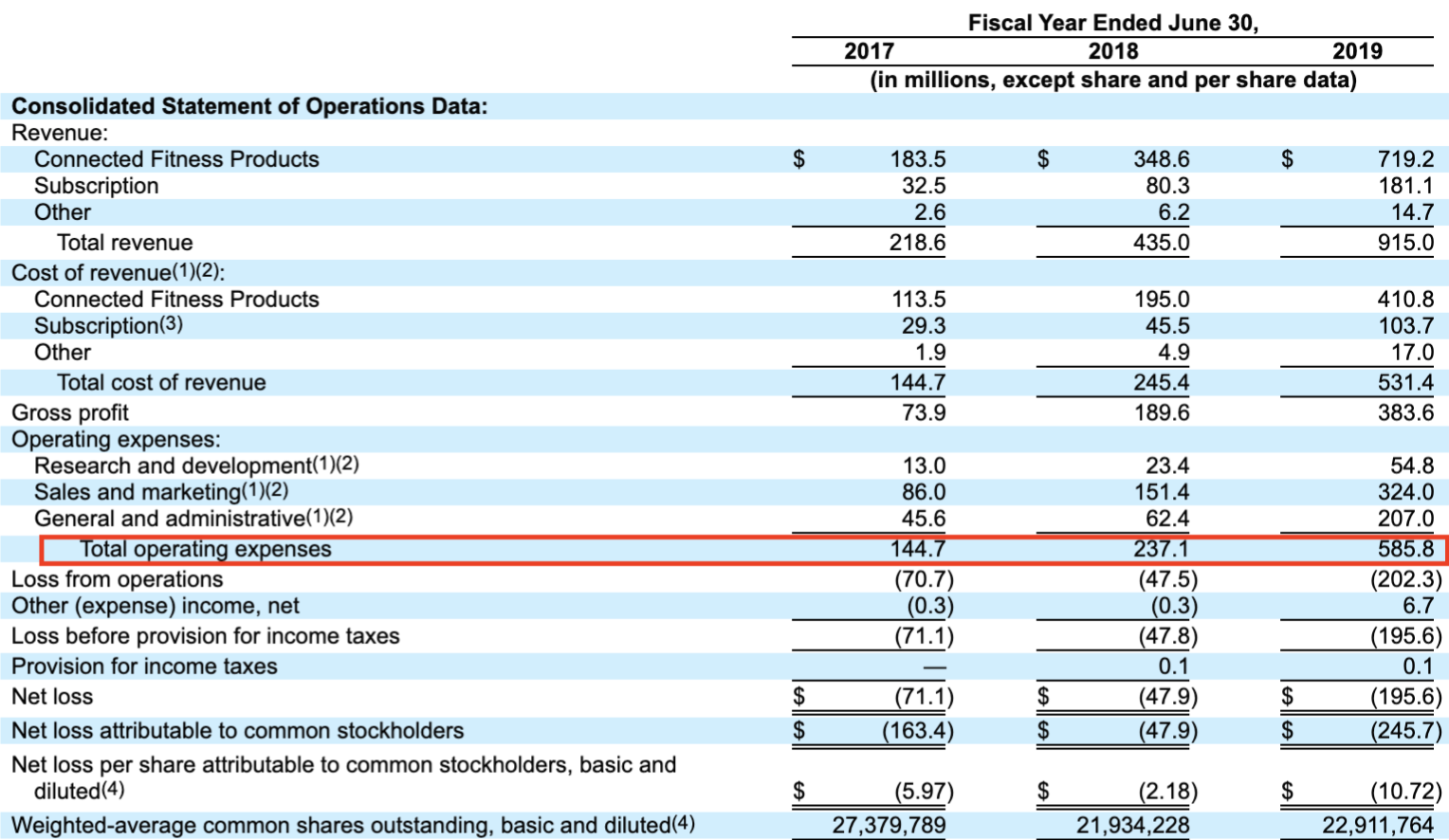

Operating Expenses are another area of concern. They have increased at an exponential rate over the last three fiscal years. When looked at more closely, there is more than a 200% increase in General and Administrative costs from 2018 to 2019. The company is not spending its money in the right places.

Research and development is a specific area in which Peloton is lacking. In the 2019 fiscal year Peloton only spent $54.8 million on research and development as opposed to $324 million on sales and marketing and $207 million on general and administrative costs. The more the company grows, the more money is lost due to the increasingly high operating expenses with an exception for research.

Another notable area of concern is as revenues grow exponentially into the positive, profits go exponentially into the negative. Peloton also boats a 95% retention rate, which is high, but does not promise a profitable future. In order for the revenue to overcome losses and generate earnings, the company has to sell as many if not more products or subscriptions. Of all the products that were connected to a membership (around 577,000 in total), 92% of them kept the membership subscription. Again, while high, does not justify or compensate for the amount of money spent elsewhere.

Our Opinion:

While Peloton has an attractive business idea, it does not mean that the company itself is worth investing in. The high prices seem not to be too much of a deterrent to customers, but the company has significant risks and is not spending their money in the right way. If the company is looking to grow, it needs to spend less on general and administrative costs and focus more on research and development for new products and a larger consumer base. Despite, CEO John Foley’s claim that they are sacrificing profitability for growth, the potential for growth is not evident enough to outweigh their unclear path to profitability.