With the Biden administration in power and democrats having unified control of Congress, one market in particular watches with bated breath – Student Loan Asset Backed Securities. With student debt forgiveness becoming an increasingly important message within the Democratic Party as a whole, SLABS have now taken on a deeper political significance, warranting an introductory look into the asset class for investors and non-investors alike.

What are Student Loans?

Student loans in the United states now make up $1.56 trillion of total outstanding consumer debt, trailing just behind mortgage debt to be the second largest consumer debt category. Student loans have historically played a more significant role in the US higher education system compared to other countries, due to higher tuition costs combined with the cultural perception that higher education in the US is the primary mode to entering the middle class. Private loans are largely handled by Sallie Mae, while federal loans have been spun off into a separate branch, Navient. Federal Family Education Loans, which are reinsured by the government, ended in 2010. Both private and federal student loans are securitized, though the most attractive of these, Federal Family Education Loans, which are reinsured by the government, ended in 2010.

After the 2008 global financial crisis, a meltdown largely caused by the collapse of the housing market and the reckless structuring of Mortgage Backed Securities, many were worried that SLABS could be the grounds of the next subprime crisis. Three main points distinguish SLABS from MBS. , Firstly they are not collateralized, unlike mortgages which are backed by housing. Secondly, the derivative market for student loans is much smaller than that for MBSs, meaning that leverage is limited and any shocks in the market are unlikely to cause further knock-on effects on the global economy like in 2008 (the macro effects of student loans in general are beyond the scope of this article). And third, student loans are much harder to discharge in bankruptcy compared to other private loans. This last point has made SLABS particularly attractive to investors due to the perceived low default risk

Even before the exogenous shock of COVID-19, there were warning signs that the student loan market could be in dangerous waters. With debt per capita steadily climbing higher but graduate income remaining stagnant, many analysts were skittish on the prospect of mass defaults. Student debt already has the highest 90 day delinquency rate for household debt, and according to the Fed, figures are likely to be understated due to various education loan policies that allow for grace periods and deferments.

What does the Biden Administration mean for the SLABS market?

To get a glimpse of how congressional policy might affect the market for SLABS, consider the effect income-based repayment policies had on the market. Prior to 2010, many student loans were issued by private lenders and guaranteed by the federal government. The Federal Family Education Loans program was ended in favor of direct loans, some of which included provisions to apply for income-based repayment at a later date. In 2015, these fully kicked in, and the resultant default implications caused rating’s agency Moody’s to downgrade several of the ABSs affected from triple A to Ba1 overnight, until issuer Navient got approval from bondholders to extend the maturity date of the bonds. In fact, July of 2020 saw $38 billion worth of SLABS being downgraded due to similar concerns over loans failing to repay at maturity.

Any debt forgiveness plan pushed through by the Biden administration would have the opposite effect. With the federal government effectively guaranteeing a portion of student loan debt, the risk premium for SLABS would greatly reduce, resulting in a fall in yield and rise in prices. However, this is looking increasingly unlikely, as the administration continues to slowly phase out student loans from their platform, with Biden being on record as being “unsure” of using executive authority to enact widespread student loan forgiveness. The macroeconomic implications of loan forgiveness goes beyond the scope of this article.

Delinquency Rates: A measure of value?

The perennial question is then: is a student loan crisis imminent? In the case of asset backed securities, one popular metric is examining the delinquency rates of the underlying debt. If delinquency rates are higher than projected, then the value of the income stream is reduced, and the value of the ABS correspondingly drops.

During the 2008 financial crisis, investors such as Michael J Burry and Steve Eisman were able to predict the forthcoming financial crisis by analysing the underlying mortgages that supported the MBS/CDO/CDS structure, and realising how risky they actually were compared to their ratings. Post-2008, significant reforms have been made to credit rating agencies. The most notable of these have been the Dodd-Frank Act which have sought to improve the accuracy of credit ratings, but the inherent incentive problem within the system (with issuing firms themselves paying for ratings), leads many to question its reliability, although some argue that such issues may be overblown .

Data Analysis

We draw data from publicly available delinquency rates from the Federal Student Aid board and use it as a proxy for the entire debt market, noting that delinquency rates for private loans are likely to be lower (given the lower interest rates for Federal loans, many prioritize payment for private loans).

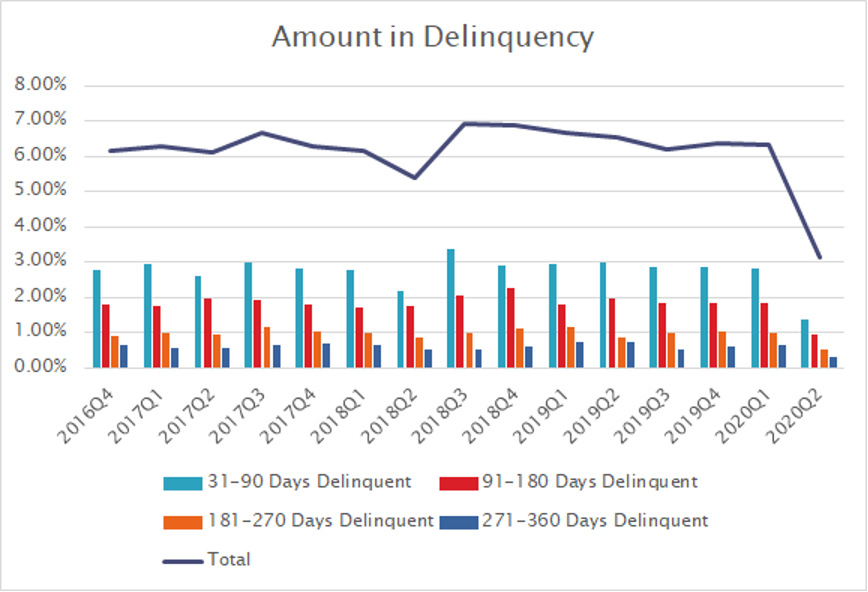

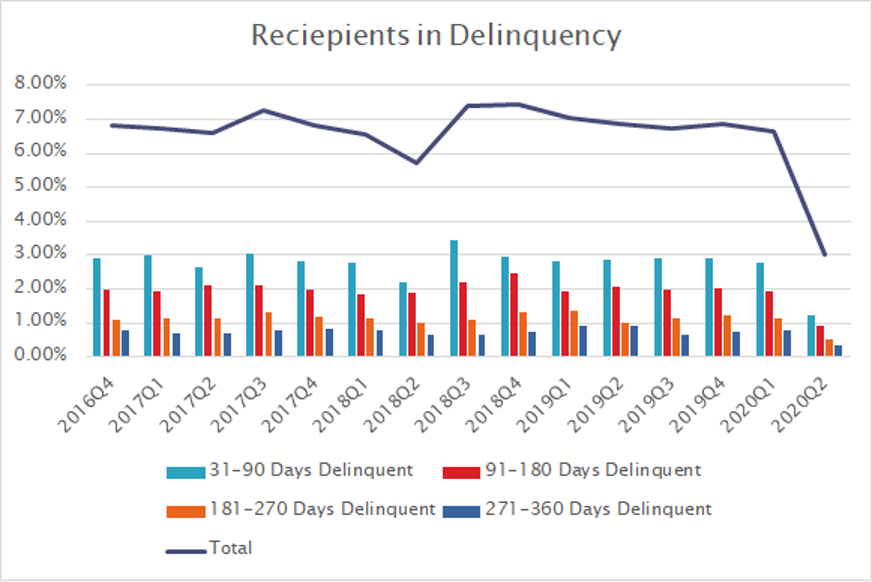

Analysing the available delinquency statistics at first glance, it seems that outcries over default are overblown. Delinquency rates show no obvious upward trend on a percentage basis, both in terms of dollars outstanding and raw number of recipients (in fact, these two figures seem to trend closely together, contrary to expectations with regards to recent trends of higher borrowing amounts per capita).

Here we note the significant dip in delinquency rates in the 2020 period, attributed to COVID-19 emergency debt relief for Department of Education (ED) -held student loans. This is significant as the economic impact of COVID-19 has not been factored into these statistics. While US unemployment figures have fallen to new lows in recent months owing to the pandemic, analysts warn this likely underestimates the true scale of unemployment, due to an overall decrease in active labour force size as well as furloughed staff. Furthermore, loans which are currently held in deferment or forbearance are also not reflected within these statistics, which amounted to roughly $255 billion in Q3 of 2019.

The Future of Student Loans

Ultimately, the sentiment on Student Loans depends heavily on a number of factors. By order of importance, they are: 1. Any form of student loan forgiveness that the Biden administration may push through 2. The economic outlook and recovery for the US post COVID-19. 3. Changes in laws regarding student loan bankruptcy, especially after the Rosenberg ruling in January 2020, where the courts ruled in favour of discharging the student loans of a Navy veteran.

With 1 looking increasingly unlikely, I doubt that SLABS are going to be the next hot investment. But I also believe that doomsayers are overblowing the situation. Even in the case of a rough economic downturn and massive unemployment, we would additionally have to see a record number of loans discharged in bankruptcy courts, as well as a complete failure on the part of issuers to renegotiate the terms of the loans and bonds. Lingering skittishness over similarities to the 2008 MBS crisis should be tempered with a reminder that said crisis was rootly caused by a bubble in the US housing market. And while there are some arguments that the value of a college degree may be overstated, most literature finds that there are definite returns on wage from a tertiary education – far from a bubble.

Overall, student loan asset backed securities seem to be a “hold” investment at best. Given the lack of macroeconomic consensus on the effect of student loan forgiveness, we are unlikely to see any sweeping policy changes to the fundamental loan structure in America any time soon. That, combined with increasingly mandatory (and expensive) university degrees means that SLABS as we know them are here to stay.

—-