By Luke Graupmann

Goldman Sachs (NYSE: GS) is one of the most recognizable names in finance, yet in recent years the company has been overlooked by investors searching for high flying growth stocks. Yet, value is traditionally one of the first areas to recover post recession and it is time to give value plays another look. Goldman is also an incredibly safe play as downside risk is limited as the company trades near book value, which nearly always acts as a floor for banking stocks in a market full of stretched valuations. In addition to this, Goldman offers strong growth opportunities as the company increases its presence in consumer banking and tech. I would advise investors looking to capitalize on the trend towards value to buy Goldman as the company provides a solid value investment with promising growth as it expands into new sectors.

Strength of Revenue Streams:

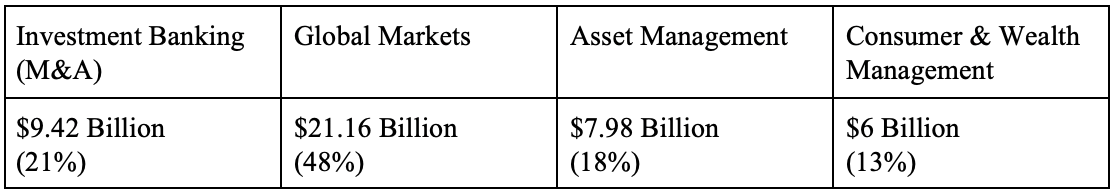

Goldman breaks its revenues into four sources (Annual 2020):

Investment Banking — According to Goldman’s Q4 2020 earning results “the firm ranked #1 in worldwide announced and completed mergers and acquisitions, worldwide equity and equity-related offerings and common stock offerings for the year.” Goldman’s dominance in M&A is well timed as low interest rates and newfound interest from corporations in owning and operating supply chains encourages new M&A deals 2021. While the rise of SPACs poses an alternative to traditional IPOs, SPACs do not pose a threat to Goldman’s revenue. Instead, Goldman stands to benefit from an increased number of companies going public through SPACs as the firm manages a large number of SPAC offerings and commands higher fees for its services in SPAC mergers than traditional IPOs. It is also worth noting that Goldman currently faces a backlog of M&A projects and expects elevated demand for their services to continue through 2021.

Global Markets — If you were to conduct a “man on the street” survey where you asked random Americans how Goldman makes money they would undoubtedly point to the global markets segment of Goldman Sachs. They would do this for good reason, Goldman’s global markets division is one of the best on Wall Street and provides nearly half of Goldman’s total revenue. Emerging from the Covid-19 driven recession, Goldman’s global markets division is well positioned to capitalize on a new bull market that will likely last years. However it is worth noting that some of the remarkable revenue global markets produced in 2020 may be hard to replicate as volatility in the market cools off.

Asset Management — Goldman’s asset management division, which manages the firm’s loans and equity investments returned 11% less revenue in 2020 than 2019, reflecting less net revenue from private equity and lower rates of return from loans. A return to normalcy post-covid should raise revenue in this segment. Goldman also increased its loan loss provisions throughout 2020 and has now drawn down its loss provisions to buy back shares as the worst fears of the recession haven’t realized.

Consumer & Wealth Management — Goldman is rapidly growing its consumer and wealth management division and returned a record $6 billion in revenue for 2020. CEO David Solomon considers this segment a key component to the firm’s future and has expanded the wealth management division to better compete with Morgan Stanely. At the same time, the firm has launched its consumer bank Marcus and has its partnership with Apple to issue the Apple Card. Net revenues in consumer banking were up 40% year over year and 10% for wealth management. This news is particularly positive as Goldman is still far from finishing its expansion in consumer and wealth management and revenue will continue to experience large year over year growth.

Growth Catalysts:

Marcus — Goldman offers exciting growth potential in consumer banking with Marcus. Launched in 2016, Marcus is a completely online bank that offers high yield savings accounts, CD’s, personal loans and helps users learn about their financial health. The bank earned #1 in personal loan satisfaction by JD Power and has over $96 billion in deposits. Goldman believes the bank will be a key part of the firm’s future as Marcus becomes a full service consumer bank. Marcus is launching a checking account and Marcus Invest, which will give users investment tools with as little as $1,000. Here Marcus is well positioned to compete against traditional consumer banks and fintech startups. On the traditional banking front, Marcus will benefit from millennials and gen-z transitioning to higher yield online banks like Marcus. At the same time, Goldman’s recognizable name and long history gives Marcus a sense of legitimacy and stability that fintech start-ups cannot replicate. Taken together, this gives Marcus a unique position in online banking that it can leverage over its competitors.

Marcus has also partnered with Amazon to compete with traditional banks to offer small business owners who sell on Amazon.com revolving lines of credit at 6.99% to 20.99%.. This is a major step for Goldman as the firm pushes to offer financing for “Main Street”. The partnership with Amazon legitimizes Goldman’s expansion into tech and provides the firm with access to a massive amount of harvestable data from Amazon sellers.

While Marcus’s revenue was only $1.213 billion in 2020, revenue is up 40% year over year and will rise even faster as Marcus’s offerings expand to fully disrupt consumer banking and compete against brick and mortar banks. Goldman’s valuation is also likely to increase as Marcus grows as we have seen fintech stocks command higher valuations than traditional banks.

Apple Card — In 2019, Goldman partnered with the world’s most valuable company and launched the Apple Credit Card. The card aims to disrupt the credit card industry and reimagine how consumers spend money, encouraging primary use through Apple Pay. Only four months after its launch in November 2019, 3.1 million Americans (2.2% of American credit card holders) had an Apple credit card. Even better, card owners tend to be millennials with higher incomes and 60% consider it their primary credit card. While neither Goldman nor Apple release data on the revenue they collect from the card, Goldman has repeatedly called the launch of the card the most successful in history. Additionally, Goldman has successfully tied itself to Apple’s incredibly loyal customer base. This has led to increased interest in the Marcus checking account, with 50% of card users stating they would open an account when available. With an average revenue per user of about $300 for Marcus[1] [2] , this would be an additional $450 million in revenue without accounting for decreased cost per user added. As such, the Apple Card is beneficial to the company whether or not it is profitable. The true success is Goldman’s new relationship with Apple customers that ensures it is on the cutting edge of how consumers spend their money.

Private Wealth Management — Goldman has provided wealth management for the ultra-wealthy for some time. Now Goldman plans to further push into this space, leveraging its ultra-recognizable brand to win over new clients with smaller fortunes in order to better compete with Morgan Stanley and other firms. Goldman is also expanding its private wealth management business to smaller investors with Marcus Invest. With Marcus Invest the firm will offer a range of ETFs to investors with as little as $1,000. While the firm has not offered what its specific management fee will be it will likely be the industry average of 0.25%. Given the growing interest in investing in the general public and the popularity of Goldman’s ETFs with its wealthier clients Marcus Invest is expected to be popular. The firm has not offered guidance on how much additional revenue this will create. However it is noteworthy there will be very little additional investment necessary for the venture as most of the investment options will just be an expansion of services the firm already offers.

A Great Stock With a Cheap Price:

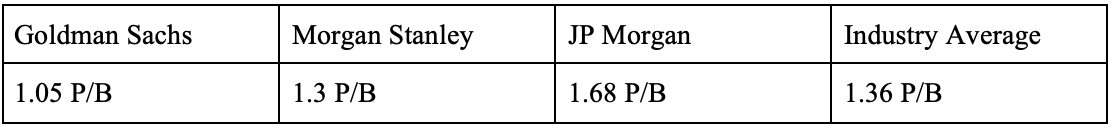

Goldman is an incredibly safe play as downside risk is limited as the company trades at 1.05 book value. Book value nearly always acts as a floor for banking stocks. In a market full of stretched valuations this downside protection is rare.

Goldman has greatly outperformed earnings expectations on the past three quarterly reports. Looking forward, Goldman is expected to continue delivering strong earnings, with 2022 EPS being 27.73. This implies a 2022 forward price to earnings ratio of 10.5, considering that Goldman will at this point likely have a significant presence in fintech the company is trading at a massive discount relative to fintech peers.

Valuation:

Despite Goldman’s recent rise, the share price remains undervalued, trading at only 1.05 price to book. This is lower than the industry average of 1.36, which is historically low as well. Given the strength of recent earning reports and the Fed’s recent decision to allow share buybacks once more, both Goldman’s and the industry’s book value can be expected to rise.

While Goldman trades at a higher price to earnings than several competitors, the valuation is justified by the corporation’s lack of a loan portfolio that has negatively impacted competitors as fears of Covid-19 driven defaults abound. In fact, when comparing Goldman to JP Morgan, who also faces less risk from loan defaults, Goldman’s price to earnings ratio seems reasonable and trades at less than JP Morgan.

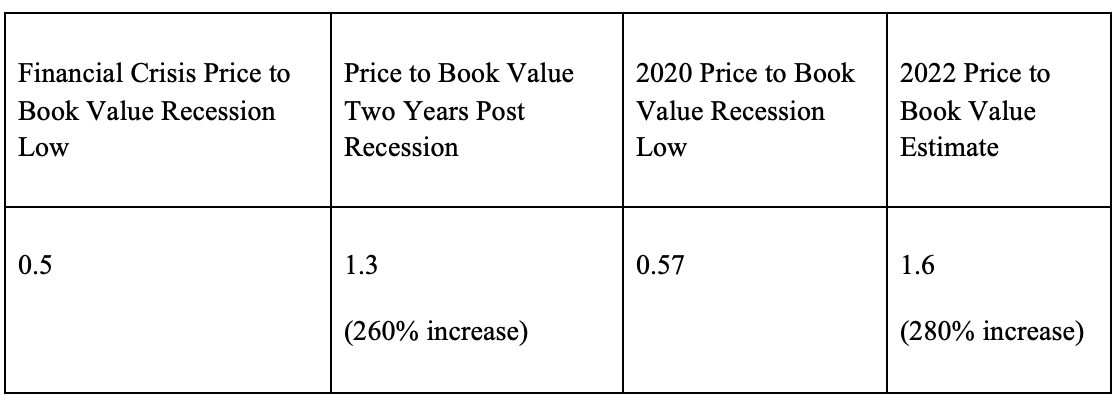

Historically, the financial sector has been one of the first industries to recover from recessions. I will use a price to book estimate for a valuation for 2022. Following the most recent recession, the Financial Crisis that lasted from December 2007 to June 2009, Goldman’s price to book ratio rallied from a low of 0.5 in December of 2008 to 1.3 price to book two years later. During this recession, Goldman’s price to book ratio reached its low in March, falling to 0.57. Using the Financial Crisis as precedent, a significant rise in Goldman’s price to book ratio can be expected in the coming two years. Goldman is much better financially emerging from this recession than it was in 2009 and does not have the negative press nor massive fines it did following the Financial Crisis. Considering these factors, Goldman can be reasonably expected to be trading at a higher price to book value two years from now than it was after the Financial Crisis. Here I will be conservative and assign a price to book value of 1.6 in 2022, which is only 0.3 above today’s industry average.

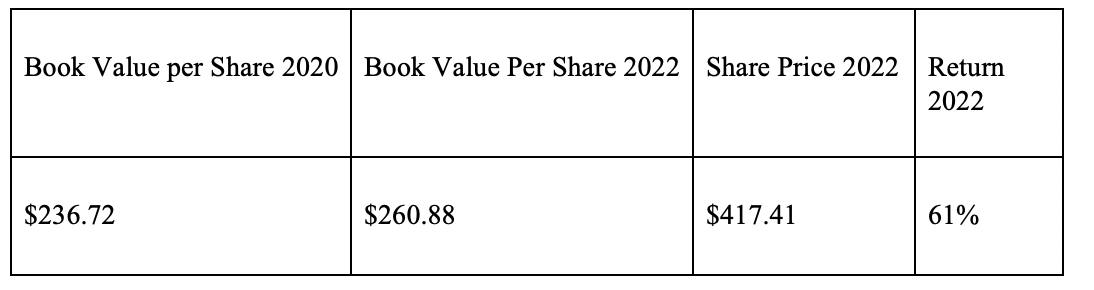

Goldman has an annualized increase in book value of 5% over the past 3 years. Given a current book value per share of $236.72, I forecast book value per share in 2022 will be $260.88 assuming the similar 5% year over year increase continues. Trading at 1.6 book value, share price is estimated to be $417.41, a 61% return from December 28th’s share price of $259.59.