Authored by Thomas Dean

Visa: A Veteran in Electronic Payments With More Room to Run

Overview:

Visa (NYSE: V) is one o f the world’s largest electronic payment networks. Currently, Visa dominates the consumer to business (C2B) segment of the electronic payment industry by facilitating transfers of money from debit cards, credit cards, prepaid cards, and a global network of ATMs. Visa processed 140.8B transactions and transferred 8.8T dollars fulfilling these services for consumers in 2020. Visa offers strong long-term growth potential, as the company targets new multi-trillion-dollar transaction markets over the next several years. Investors should consider Visa as a means to capitalize on the global transition from cash and checks to electronic payments in all segments of the economy. This report’s price target for Visa is $374, which suggests Visa is currently trading at a $176 discount at its current price of $198.

Industry Overview:

Visa is the leading company in the payments technology industry. Payment technology companies provide other entities, such as companies and individuals, with the means to transfer funds safely and efficiently. Other prominent companies in the space include Mastercard and Paypall. The industry includes payments made with credit and debit cards, as well as any electronic transfer of funds from person to person, person to business, business to business, business to consumer, or government to citizen. The payments technology industry is expected to grow significantly in the coming years as digital repayments replace cash and more individuals in developing countries gain access to digital payment networks.

Revenue Streams:

Visa splits its revenue into four main categories (Data from 2020).

| Service Revenues | $9.8B |

| Data Processing Revenues | $11B |

| International Transactions | $6.3B |

| Other Revenues | $1.8B |

Service Revenues Overview: 9.8B

Service revenues are the fees Visa charges to clients for the use of Visa products. For example, a fee Visa charges to banks for supporting monetary transfers on their credit cards would be classified as service revenue. Service revenues are based on the amount of money that is transferred, not the number of transactions. So, a larger credit card issuer would pay more in service revenues than a small fintech startup like because the larger bankmoves more money with its credit cards. As Visa breaks into new monetary transfer markets and continues to expand the total dollar amount of transactions it facilitates, service revenues are expected to increase.

Data Processing Revenues Overview: 11B

Data processing revenues are fees Visa collects for authorizing, clearing, settlement, and other services that facilitate transaction and information processing. These fees are separate from service revenues and scale with the number of transactions that Visa executes, because data processing fees are collected at each transaction, regardless of its size. Similar to service revenues, entrance into new transfer markets and movement away from cash payments will only increase the number of transactions Visa facilitates, which will lead to an increase in data processing revenues.

International Transactions Overview: 6.3B

International transaction revenues are generated from fees collected from transferring money across borders. Fees collected from currency conversion are also attributed to international transaction revenue. Due to the reduction in global travel caused by the Covid-19 pandemic in 2020, international transaction revenues decreased by approximately 20% in 2020. However, while there is no way to know exactly how much international transaction revenues will rebound until the 2021 annual report is released, strong quarterly earnings from Visa suggest international revenues have done well so far in 2021.

Other Revenues Overview: 1.8B

Any revenues not covered by service revenues, data processing revenues, and international transaction revenues fall in the other revenues category. These revenues are primarily generated from Visa’s ‘value-added’ services, as well as licensing feeds, account holder fees, ect. Value-added services, such as fraud management and security, data solutions, and Visa consulting & analytics rose 18% in 2020. While other revenues do not represent a major portion of Visa’s revenues, they represent Visa’s ability to adapt, expand, and offer new services that are well received by consumers.

Financials and Operating Leverage:

Visa has sustained consistent revenue growth in revenue, operating income, and net income for several years before 2020. Even with the Covid-19 pandemic, annual revenue only decreased by 5% and net income decreased by 10% in 2020. The company’s healthy financials are confirmed by its statement of cash flows. Visa has constant positive and growing cash flow from operations before 2020, relatively flat cash flows from investing, and negative cash flows from financing as a result of paying dividends to shareholders. In 2020, the only significant change on the cash flow statement was a reduction in operating cash flows of around 20%, which was primarily caused by decreases in international transaction revenues. Visa’s balance sheet highlights steadily increasing assets while maintaining a gradually increasing debt level. Overall, Visa’s financial statements suggest it is a financially stable and healthy company, which is a breath of fresh air in a market filled with sky high speculative valuations on non-profitable companies.

Visa’s income statement is particularly interesting. The company’s total costs are mostly constant, varying between $7 and $8 billion per year. There is some slight fluctuation between years where revenue is higher or lower, but the company’s largely constant level of total costs suggests the vast majority of Visa’s costs are fixed. As a result, the company has a high degree of operating leverage. This is visible in the company’s high EBIT margin, as a dollar of revenue flows almost flows directly down to EBIT. As Visa makes more money, net earnings will grow at a faster rate than overall revenue growth, which makes Visa a very attractive and profitable investment if the company sees significant growth in revenue.

Catalysts for Growth:

Cash Payments

According to Visa’s 2020 annual report, there are an estimated 18 trillion dollars worth of annual transactions executed with cash globally. Management indicates that one of Visa’s primary goals is continuing to shrink the amount of cash transactions to zero over the next several years. As a result, there is a very large pool of transactions available to Visa to fuel continued growth. These transactions would also fall within Visa’s existing cost structure, so new revenues would be attained at historically large margins.

New Flows

Visa is also looking to move into new monetary transaction markets. In the next few years, Visa hopes to expand its operations from mostly Consumer to Business (C2B), to include person to person (P2P), business to consumer (B2C), business to small business (B2b), business to business (B2B), and government to consumer (G2C) transactions. Visa estimates these combined markets generate $185 trillion in payment volume. While breaking into the person-to-person market will be difficult due to high competition, Visa is favorably situated to move into every other market. As a veteran of the industry, Visa has a reputation for fast, secure, and reliable payment movement. This brand recognition makes governments and large businesses more likely to look to Visa for electronic payments to replace wire transfers and checks rather than upstart competitors, who lack a reputation of facilitating fast, reliable, and secure transactions. While it is very difficult to know exactly how much of these markets Visa will be able to obtain, and what their cost structure in these markets will look like, one thing is clear. Visa is favorably situated to gain a significant market share in these markets. Secondly, moving into these markets will not cost Visa significant research and development or asset procurement – they already have all the infrastructure and systems necessary to support these markets from their current business.

Risks and Mitigations:

While Visa is a strongly positioned and financially sound company, there are some risks to consider. The payment network space is a highly competitive environment – Visa leads the market, but faces stiff competition from companies like Mastercard and Paypal. There are also numerous new entrants into the payment network industry in the form of startups. These startups are at a significant disadvantage to Visa – gaining users, building a reputation for security, and building a reliable payment network take significant resources and time. However, given the volume of startups, there is a possibility that a small number could grow to significantly compete with Visa.

Visa may also face pricing pressure on its services from major retailers. Visa, like all companies that provide payment services to credit and debit cards, charge vendors fees for facilitating the transfer of money from a customer to the vendor. Recently, large vendors have been complaining that these fees are too high, and Amazon took an unprecedented step of refusing to accept Visa cards in the U.K. While concerning, this is likely Amazon playing chicken with Visa to try and squeeze out a little more profit. In general, large vendors need Visa’s payment network and services to sell products, and Visa will continue to grow revenues as more people adopt electronic payments, even if they face some pricing pressure.

Valuation

Model Summary:

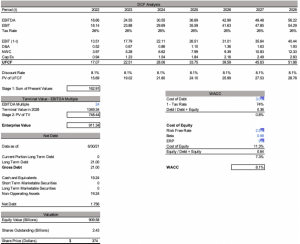

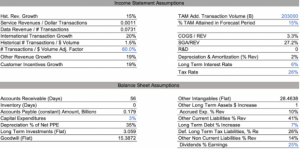

A three statement model was used to create a price target for Visa. The model is driven by assumptions about how Visa will take market share from cash translations and expand into the cash and ‘new flows’ market. With the market size information provided above, the model sets the total addressable payment volume at $203 trillion. The model assumes this amount remains constant, and Visa gains a set amount of the total market share each year. Based on how much market share we assume Visa captures over the next seven years, the model uses historical levels of revenue / $ transactions and revenue/ # transactions to forecast revenue. Costs and items on the balance sheet were projected forward to reflect historical levels as accurately as possible. The output of the three statement model is used to create a DCF analysis. The output of the DCF, with our TAM market capture set at a conservative 15% over 7 years, yields a stock price target of $374 per share, a premium of $176 over its current price of $198.

Model Inputs (blue indicates assumptions):

Financial Statements:

DCF Analysis: