Authored by Nick Harrington

Overview

Silvergate Capital Corporation (NYSE:SI) is a mid-cap financial services company that has one of the most unique and attractive business models in the sector.

Founded in 1988, Silvergate began its life as a standard commercial bank. In 2013, Silvergate launched its digital currency initiative, seeing an unmet need for traditional banking services in the cryptocurrency sector. This pivot has been outstandingly successful, boosting Silvergate’s market cap from $270mm in October 2020 to nearly $5.7bn as of 11/24/2021.

Core business model

Silvergate’s business model is somewhat unintuitive, but it is critically important to understand. Silvergate’s key product is something called the Silvergate Exchange Network (SEN), a payments platform that Silvergate’s institutional clients — exchanges, hedge funds, asset managers, fintech companies, etc. such as Fidelity, PayPal, and the CME Group — use to instantly settle large cryptocurrency transactions. The SEN’s utility stems from the fact that cryptocurrencies trade 24/7 with no regulated market hours, making them somewhat incompatible with the existing financial infrastructure, which operates on a more rigid schedule. If a hedge fund wants to purchase a large quantity of bitcoin from a crypto exchange, the bitcoin can be transacted instantly but the USD payment will take somewhere from several hours to several days to complete using traditional electronic funds transfer methods, inducing capital inefficiency, friction, and counterparty risk. This is where the SEN comes in. If the imagined hedge fund and crypto exchange are both on the SEN, the hedge fund can transfer USD payment directly from its SEN account to the exchange’s SEN account, instantly settling the transaction and eliminating the negative effects associated with the lag time.

It is hard to understate how valuable this service is. The SEN’s extreme utility has resulted in SEN deposits increasing 447% YoY from $2.1bn to $11.5bn as of Q3 2021. Quarterly transaction volume on the SEN increased 341% YoY from $37bn to $162bn. 99.3% of Silvergate’s deposits are now non-interest bearing, bringing its cost of funds to zero basis points. The SEN’s rapid growth shows how valuable crypto market participants find the network. And because the SEN is so value-additive, Silvergate is able to bring in deposits without paying out any interest; Silvergate then invests these interest-free funds in interest-bearing instruments, earning a profit on the (abnormally high) spread between these two rates, all thanks to the SEN.

Network effect

High growth and profitability are not enough on their own to indicate an exceptional business. There is no guarantee that a high-growth company will be able to sustain that growth (and the same can be said for margins). Fortunately, this is not the case with Silvergate. The most important thing to understand about the SEN is the powerful network effect it produces. Because the SEN is more or less creating a marketplace between buyers and sellers of cryptocurrencies, each incremental user of the SEN makes the network more valuable for all other users. In this sense, the SEN is not too different from a social network like Facebook, which is so dominant not because it has the best technology or the most superior user experience, but simply because it has the most users. It would be trivial for a competitor to create a platform similar to the SEN; it would be much harder to induce institutional crypto traders to actually use that platform, since the value of the platform comes from its participants.

Indeed, the SEN stands out amongst comparable networks in terms of the strength of its network effect. As hegemonic as a platform like Facebook may be, it’s relatively low cost for a Facebook user to open up an account on a competing social network to try it out. Alternatively, consider a company like Airbnb. Airbnb enjoys a similar network effect, since it provides a platform that connects those seeking accommodations for rent with those offering them. However, Airbnb suffers a similar problem: hosts on the Airbnb platform are also able to list their properties on VRBO or Booking.com. As strong as the Facebook and Airbnb networks may be, they’re made vulnerable by their inability to prevent users from moving to competing platforms. The SEN is different — since SEN usage by definition requires a deposit into the SEN, participants find themselves bound to the SEN. They could make a parallel deposit in a competing exchange network, but doing so would require an unnecessarily large capital commitment.

Collateralized lending, stablecoins, and more

The SEN is the core of Silvergate’s business. However, part of what makes Silvergate such an attractive investment is that it’s more than just the SEN — the SEN also serves as the foundation upon which a broad suite of services can be offered, opening up multiple avenues of growth. For example, Silvergate has been growing its SEN Leverage product, which offers institutional traders participating in the SEN access to USD loans collateralized by bitcoin. SEN Leverage loans totaled $322.5mm in Q3 2021, up from $35.5mm a year prior, and the program has not yet incurred a loss.

Valuation

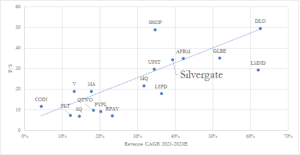

Silvergate is a quickly-growing, highly-profitable first mover with a very compelling business model in a nascent sector. But how much is it worth? This is where things get tricky, because the market has begun to recognize Silvergate’s potential. When I first pitched Silvergate to Insight on October 27, it was trading at $147/share with a 23.5x sales multiple. When I first pitched it to a buyside PM on September 8, it was trading at $111, 20.2x sales. Since then, a few pieces of highly favorable sellside coverage have sent shares sharply higher to today’s close of $222.13, 35.5x sales.

At 20x sales, Silvergate was extremely undervalued. Its growth profile, margins, and business model were vastly superior to similarly valued companies. At 36x sales, things are less clear cut.

Silvergate combines high margins with high growth, and the SEN’s network effects mean that this can be sustained over an abnormally long time horizon. Furthermore, the underdeveloped nature of sector in which Silvergate operates augurs opportunities to grow beyond the SEN and provide a wider suite of financial services to the cryptocurrency sector. With all of this in mind, Silvergate remains very attractive despite recent price appreciation, and I expect its shares to outperform over at least a 3-5 year time horizon.