Authored by Luke Graupmann

Porsche – An Iconic Symbol of Wealth that Might Just Help You Grow Yours

Overview:

Porsche SE Holdings (OTCMKTS: POAHY) trades as an ADR over the counter in the US with a convoluted holding structure that mostly owns Volkswagen equity. To be clear, when investors buy Porsche SE, they are not directly buying the iconic car company, which is known and will be referred to in this article as Porsche AG. This limits investor enthusiasm but creates a compelling opportunity to buy Volkswagen at a ~37% discount compared to its own shares. Beyond this discount, Volkswagen itself is positioned for significant multi-year earnings growth as it transitions to electric vehicles and it gains market share in Europe. Finally, while providing stable returns through its Volkswagen investment, Porsche SE’s stock offers the chance for massive returns from a spinoff of Porsche AG (the actual car company) for an IPO listing. In this article I will first dig into Porsche SE’s financial structure and why it offers a discounted price on Volkswagen equity before examining Volkswagen’s underlying business and the implications of an IPO listing of Porsche AG.

Financial Structure:

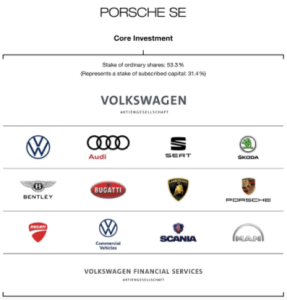

In a complex financial structure Porsche SE owns 53.3% of Volkswagen’s equity. Volkswagen itself then owns and manufactures its car brands, including Porsche AG. This breakdown is seen below.

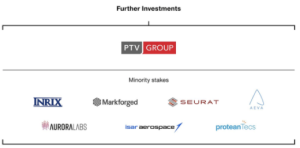

Beyond Volkswagen, Porsche SE also holds promising investments in industries auxiliary to automotives, specifically companies specialized in automotive software, lidar, 3d printing, traffic analytics, satellites and their launches and the semiconductor industry.

While these investments are promising and offer some upside, over 90% of Porsche SE’s invested capital is in Volkswagen, so I will now turn my attention to how Porsche SE equity is valued compared to its underlying investment in VW.

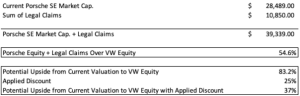

Since Porsche SE owns 53.3% of VW’s equity, its market cap should be roughly 53.3% of Volkswagen’s $135.2 billion market cap, about $72 billion.

![]()

However, Porsche SE’s current market capitalization is only $28.5 billion, 60% less than the implied market cap. While part of this discrepancy can be attributed to the $10.8 billion in legal claims against the holding company, this does not fully account for the discrepancy. Even if Porsche were forced to pay the maximum amount of legal claims against it, which seems significantly unlikely given comparable rulings against VW, Porsche SE still trades at only 54.6% of its underlying equity in VW and means that as an investor you are getting Porsche SE’s auxiliary investments for essentially nothing.

This discount is likely due to the complex financial structure of Porsche SE and has historical precedent. In each case where such a discount in Porsche compared to VW equity has occurred before, Porsche SE has eventually caught up to within 25% of VW’s valuation. Applying this discount, Porsche SE becomes a compelling arbitrage opportunity, providing roughly 37% upside from current valuation when compared to its underlying investment in Volkswagen and subtracting 25% to account for the discount. However, investors should not just use Porsche as a quick arbitrage opportunity but buy its stock as a long term investment in VW at a discounted price.

Volkswagen’s Transition:

In 2015 Volkswagen appeared to be a company near collapse. So called “dieselgate,” where the company programmed cars to lessen their emissions when tested for regulatory compliance then increase emissions when on the road for better performance and fuel efficiency had just been uncovered and the company faced tens billions in recalls, buybacks and legal fees. In just a few months the stock halved and calls to break up the conglomerate emerged. Since then, Volkswagen’s stock has not only recovered but returned 141% since 2016, outperforming the S&P by 20%. VW’s sizable investment in battery technology, electric vehicles and portfolio of high margin luxury vehicles promise to accelerate these returns over the next five years.

VW research has committed ~$81 billion to battery factories, tech and charging stations through 2025 and completely phase out gas cars by 2030. This massive investment is needed, the company’s investments in EVs and rollout of EV cars has fallen behind both new EV companies like Tesla and legacy automakers like GM and Ford in their EV transition and innovation. However, the company has now committed to producing 1 million EVs by 2023, a goal it is currently on track to achieve. It also plans to expand its European charging network to 18,000 charging stations, which will allow it to collect recurring revenue from its EVs on the road and further market its EVs as practically useful. Volkswagen already has several EVs on the road across a spectrum of brands from premium to affordable, allowing it to compete with Tesla on all fronts and extract high margins on its luxury Porsche and Audi EVs.

Volkswagen also has a locational advantage among legacy automakers in the EV race. With 26% of automotive market share in Europe and 20% of market share in China VW is well positioned to to roll out its EV lineup to a receptive market. Together Europe and China represent the two largest EV markets, respectively making up 43% and 41% of the entire EV market. This creates a competitive advantage for VW compared to Tesla and legacy automakers in the two largest EV markets as it leverages existing relationships into EV sales in two critical automotive markets that will likely decide who wins the EV race. This is particularly important in the short term as EV margins for the short term are expected to be lower than traditional cars due to battery development costs. VW can help makeup some of its lost profits from margins with higher volume, which appears likely as they leverage existing market share into future EV sales in critical markets.

3 Year Valuation:

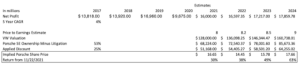

Volkswagen’s EV transition should also help increase its earnings multiple, which is currently only 7.7 price to earnings. This is below major competitors despite a similar EV strategy, strong battery tech, higher EBITDA margins and dominant market share in strategic markets. Looking at GM, Ford, Daimler, BMW and Toyota for comparison, the industry average is 10.5, however this average is skewed by Ford, which trades at 26.4 price to earnings, more than double the nearest competitor. Thus, for conservative estimates I will ascribe VW a multiple of only 9 in 2024. Modelling earnings, I estimated that earnings will continue to grow at its historical 5 year CAGR, which is conservative given the EV transition in Europe is expected to expand VW’s market share and long run margins should be similar to ICE cars. This results in a 2024 earnings of $28.3b, which multiplied by 9 implies a valuation of Volkswagen of $229.4b. From here valuing Porsche just requires multiplying VW’s valuation by Porsche’s ownership stake. Once again, to be conservative I have subtracted Porsche’s total possible litigation expense from its valuation and a 25% discount. This gives a 2024 share price of $17.66, returning a respectable 63% from 11/3/2021.

Spinoff

There is also a significant chance that Volkswagen chooses to spin off Porsche into a separate company with an ipo listing sometime within the next few years. Such calls have been repeatedly called for by major investors and management appears receptive to the idea because of the high probability for a higher valuation of Porsche separately (makes up the largest portion of VW’s profits and is a higher margin, more stable business than the other brands). Such a spinoff also have historical precedent as Fiat Chrysler spun off Ferrari in 2015. This spinoff was a major success, investors in Fiat Chrysler were given shares in the new company (which has since quadrupled in value and trades at a much higher valuation) and Fiat Chrysler stock more than doubled in the next few months. A similar outcome that gives Porsche Holdings cash and investors direct shares in Porsche AG appears likely where Porsche AG to be spun off.

Overall:

Overall Porsche is a compelling investment that offers a 37% discount to VW’s equity while accounting for a 25% equity discount. At the same time, VW itself is a strong investment. Because of this, Porsche is a buy.