Authored by Daniel Pompi

Overview:

Chipotle offers a wide range of Mexican dishes at a competitive price made from high quality, fresh, and healthy ingredients. With over 2800 stores in the US alone, and dozens more across 4 international countries, they pride themselves in fast service, and convenience. Chipotle’s menu is focused on serving dishes that align with their signature dining experience.

As a return to office-work continues, and the worst of the Covid-19 pandemic hopefully over, restaurants benefit from an influx of patrons and support.

Chipotle Mexican Grill (NYSE: $CMG)

Highlights:

During the Covid-19 pandemic, restaurants were crippled by a sharp decline in revenue, leading to a declined industry growth rate of only 4% in 2020: the lowest in years. However, during this same period, Chipotle saw an increase in revenue by over 7%, nearly double the rate of the rest of the industry. Chipotle has outperformed its competitors by similar margins in both 2018 and 2019.

In 2021, the restaurant industry is projected to grow by 9%, suggesting a positive trend for a hard hit industry. Chipotle’s quarterly reports indicate they will continue to outperform their competitors for the fourth year in a row. Following their Q3 earnings on October 21, 2021, Chipotle announced a 21.9% increase in revenue, beating their counterparts who posted increases hovering just below 15%. In the previous two quarters, Chipotle posted similar results including a 38.7% increase in revenue between Q1 and Q2.

Another catalyst for growth has been Chipotle’s introduction of new menu items. During 2021, Chipotle introduced cauliflower rice, brisket, and quesadillas. These introductions have been well accepted by the public. The announcement of each new menu item has been met with a roughly 2% increase in the share price of Chipotle. Chipotle’s menu innovation, and aggressive Chief Restaurant Officer, Scott Boatwright, support a compelling product lineup to increase traffic and sales over the upcoming years.

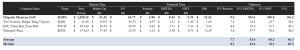

Each of these promising components of Chipotle’s outlook for 2021 and beyond can be realized by the red-hot multiples when compared to those of other, similarly capitalized, fast casual restaurants. While they may flicker signs that the company could be overvalued, I view these as signs of investor enthusiasm of what is to follow in 2021.

Risks:

Chipotle does have risks that should be taken into consideration.. Purely based on Chipotle’s 36% increase in share price since January 1, 2021,Chipotle’s growth may be unsustainable. In the same period where the S&P returned over 25%, Chipotle has outperformed what many consider to be the benchmark for the market. While I do not believe that Chipotle’s share price will grow at such a high rate in 2022, that is by no means any indication that its growth is complete.

Chipotle’s multiples are far higher than their competitors. is a stock that has grown 36% YTD overvalued? While Chipotle’s multiples are high compared to other fast casual chains, none of these other corporations are in direct competition with Chipotle, and most have a dissimilar business model. While Chipotle focuses on a healthy, focused, appropriately priced menu, the same cannot be said for competitors such as KFC, Burger King, or Popeyes, whose primary goal is to produce incredibly cheap food. Therefore, it is difficult to compare Chipotle’s multiples to other fast food chains crowding the market. Panera would offer a great comparison, though they went private in 2017.

Based on evidence of Chipotle’sinnovative menu and consistently high earnings,Chipotle’s high multiples are a result of investor enthusiasm for continued business practices into 2022.

Finally, any further resurgence of a new Covid variant is another risk that may make investors uneasy. That said,Chipotle’s increase in accessibility outside the dining room has them covered. With delivery service revenue accounting for a greater percentage of total revenue and drive-through “Chipotlanes” being implemented into a record number of stores, consumers have more options to get their food without stepping foot in the store. Should any new restrictions be implemented, Chipotle is well prepared to serve record numbers of customers as they have done throughout 2021.

Industry Outlook & Catalysts:

As noted above, the restaurant industry as a whole is expected to grow at a CAGR of 9% during 2021, a number that Chipotle is well positioned to exceed. Chipotle benefits from limited direct competitors such as Qdoba and Dos Toros, in addition to a barrier to entry for new firms in the market for healthy, fast, Mexican cuisine.

Delivery service and Chipotlane revenue have continued to grow at a record pace, indicating Chipotle is more easily accessible than ever before. Currently, Chipotle has implemented their drive through lanes in 9% of their stores. Following their report that stores with Chipotlanes have generated 15% higher sales on average than stores without them, Chipotle has announced that they plan to implement them in 30% of their stores by 2025. Chipotle has also committed to, and are on track to open over 200 stores in 2021, bringing their total number of establishments to just under 3000 across five countries.

One of Chipotle’s most promising streams of revenue is that of their delivery options. Through promotions on popular delivery apps such as UberEats, it is easier than ever to have Chipotle delivered to your door. The revenue growth from their delivery services has nearly tripled between 2019 and 2020, shown in the graph above. As this trend continues and Chipotle further incorporates technology into their business model, digital sales will account for a larger percentage of overall sales, and delivery service revenue will account for a larger percentage of overall revenue, further boosting Chipotle’s share price.

Chipotle’s introduction of new menu items has been a reliable catalyst for growth. Their introduction of new menu items in 2021 each were well received by the public, and Chipotle’s leadership team will continue to aggressively implement new menu items to increase traffic and sales well into 2022, while maintaining their concentrated menu.

A final catalyst for growth will occur when the return to office is complete. Many of Chipotle’s patrons are office workers who are in search of a quick, healthy, affordable lunch. As firms announce their commitment to the return to office, we will see Chipotle’s sales traffic increase steadily. This will mark the increase in Chipotle’s traffic in the final of three ways: 1.) Chipotlanes, 2.) Delivery Service, 3.) Traditional Sit Down.

Conclusion + Recommendation:

Based on the catalysts discussed above, and the limited downside, I suggest a buy of Chipotle at a share price of $1799. While this is not a short term recommendation, nor a recommendation for a high growth company, I do believe that Chipotle will continue to experience moderate growth throughout 2022. Therefore, it is a safe stock to own in any well-diversified portfolio.

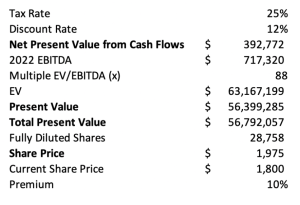

To arrive at my price target, I implemented a discounted cash flow model where I increased Chipotle’s revenue growth assumptions to align with historical data. Additionally, I valued the company at 85% of its current EV/EBITDA multiple to price it similarly to other similar-cap fast casual corporations. With these assumptions in place, I drew the following conclusions:

Based on my analysis, I recommend a buy of Chipotle at its current price of $1799, with a price target of $1975 by the end of 2022, a 10% premium. Even if Chipotle does not continue its record-paced 2021 growthChipotle will experience strong moderate growth over the following year, which makes it a valuable stock to own in any portfolio.