Accenture PLC (NYSE: ACN)

Market Cap: $237.41B

P/E Ratio: 39.49

Authored by Masaki Lew

Overview:

Accenture PLC is a multinational consulting and technology company, offering Marketing and Business Strategies, Supply Chain Management, and Operation Models as well as several processing services ranging from Intelligence Operations and Digital Infrastructure to clients. In addition to its two major services, the company commits to research and investment. Accenture Insights, the predominant research department focused on innovations in Artificial Intelligence, Blockchain, and Cloud Technology. Accenture Venture, the Venture Capital department conducts engagements, investments, and prospective subsidiaries for future services. Founded in 1989, Accenture has since moved its headquarters and incorporation title to Dublin, Ireland.

Investment Reasoning:

Accenture’s recent strategy in establishing itself as a major player in the Cloud and AI Technology space as well as a primary financier for Blockchain projects point to an expanded outreach in the post-pandemic economy. In September 2020, Accenture unveiled a $3 billion investment project into the new Accenture Cloud First program set to accelerate their client’s digital transformation to the Cloud. Amid the pandemic, several smaller companies have transitioned to the Cloud digital network to overcome the speed, structure, and reliability necessary in the ongoing crisis.

Accenture fundamentally believes that the dramatic growth in “Cloud-first” companies is here to stay in a post-pandemic economy. Thus, Accenture Cloud First’s services in cloud migration, infrastructure, and application services capitalize on these conditions. The company’s strong investment history in Applied Intelligence capabilities, such as its April 2021 acquisition of Core Compete, are directed towards integrating client supply chains into the Cloud. Accenture also lined out a detailed plan about Edge Computing’s role in centralizing company data.

Investors should understand that Accenture is experienced in operating large IT infrastructure and a grand expansion into an advanced technological network would play well to the company’s strength. As more industries command higher efficiency, Accenture’s vision of a general migration to the Cloud from 20% of business in September 2020 to 80% will only be increasingly realized. Thus, the demand for Accenture services is on the rise, evidenced by the nearly 22 Cloud blueprints and over 100 Cloud solution strategies developed in the program so far.

Likewise, Accenture has been a leader in coordinating the Banking and Financial sectors’ transition to Blockchain technology. As a revolutionary method to enable secure access to shared data across peer organizations, the rise of Blockchain is simultaneous with an increase in Artificial Intelligence dependent on trustworthy data to operate. Accenture’s Ventures holdings in Blockchain not only offer market presence in the field, but are ultimately investing back into its AI Development programs. A particularly notable decision in September 2020 was Accenture’s investment in Baseline Protocol, the predominant server technology to upgrade the popular Ethereum cryptocurrency.

Competition:

Accenture’s diverse investment strategies all culminate to an increased demand in services in a Cloud-first interconnected business world. Though already with $11 billion in revenue from Cloud technology, its recent strong evaluations come from the early fruition of these 2020 investments in Artificial Intelligence, Blockchain, and the Cloud. This multifaceted approach creates a unique advantage over its competitors. In the traditional sense, Accenture faces steep challenges from major consulting firms such as Bain & Co. and McKinsey & Co. How Accenture will fare against stronger, more reputable financial consulting is difficult to estimate. However, in the technology development sphere, Accenture is positioning itself strongly against Capgemini and IBM. As the Cloud technology industry is already predicted to grow to $850 Billion dollars by 2025, a CAGR of 17.5% compared to 2020 values, it seems intuitive that Accenture will benefit immensely from this growth.

Financials:

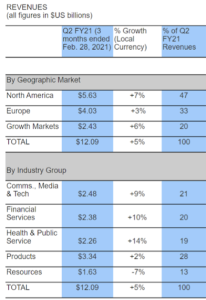

Revenue Growth has increased significantly in the North American Cloud storage market with a 7% growth for Fiscal Year 2021. Communication, Media & Tech, as a whole, generates the majority of Accenture’s service-based revenue and is expected to have strong showings in nominal and percent growth.

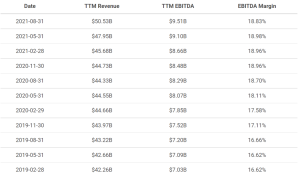

EBITDA over the last year has grown as a margin of revenue, showing positive signs of stronger profits in the coming years. The new revenue coming from the Accenture Cloud First Program has demonstrated higher percent profitability compared to traditional revenue streams. We see this as the EBITDA margin has grown and stabilized at just shy of 19% percentage points over FY21, with a $1.22 Billion nominal TTM revenue growth compared to a $960 million growth in TTM EBITDA. Accenture’s program demonstrates strong profitability and earnings compared to IBM’s declining earnings.

Competitor IBM EBITDA:

2020 $12,854

2019 $15,955

2018 $16,672

As of now, Accenture’s P/E ratio has hit major peaks and investor sentiment has responded. With EV/Revenue and EV/EBITDA set to gradually decline, Accenture’s revenue streams are likely to meet current valuations in the coming years as it continues its expected growth patterns. For investors, these growths will be matched with optimistic stock valuations well into 2023.

*Note that the declining EV is largely from this particular evaluation that Accenture stock will fall from overconfidence, that has little to do with the financial fundamentals.

Conclusion:

My recommendation is to take a Long Position in Accenture. Accenture’s upside potential greatly outweighs its risks as its major programs have shown early signs of success, generating a 3% revenue growth over the last 6 months. Most of this new growth is leading to higher profit margins than previous revenue increases. Compounded with the declines in other technology consulting companies, it is fair to assume Accenture will acquire a stronger role in the post-pandemic market. In the short term, Accenture has stabilized at a somewhat overvalued stock price: it’s P/E ratio’s rise by nearly $10 evidence of an incredibly optimistic demand; therefore, it may be wise for investors to buy in after any shift in unwarranted market decline.

Sources:

Data:

https://newsroom.accenture.com/fact-sheet/

https://www.macrotrends.net/stocks/charts/ACN/accenture/ebitda-margin

https://www.marketscreener.com/quote/stock/ACCENTURE-PLC-11521/financials/