By Drake Mead

Recent Shifts in the Gambling Industry

In 2018, the state of New Jersey won a landmark supreme court case, Murphy v. National Collegiate Athletic Association (initially Christie v. NCAA, but the case was renamed after Phil Murphy was elected governor). This case struck down the Professional and Amateur Sports Protection Act of 1992, which had basically given the state of Nevada a monopoly on sports gambling, and more importantly from the standpoint of gambling companies, limited their operations to the state of Nevada. This development caused the gambling industry to explode in New Jersey. By May 2019, only 11 months after the legalization of sports wagering in the state, New Jersey sportsbooks took in more in monthly wagers ($318.9 million) than Nevada ($318.3 million), and NJ repeated the feat in in July, taking in $251 million versus $235 million in wagers in Nevada. Note that the month-to-month change in wagers is not due to a slowdown in the industry, but rather because May is a much more active month sports-wise than July, with the NBA and NHL playoffs occurring. Multiple other states have legalized or are in the process of legalizing sports betting. Indeed, according to Morgan Stanley estimates, the legal sports gambling business will generate $7 billion in revenue by 2025, compared to $833 million this year, a 740% increase. That’s up from their $5 billion estimate last year, and in the (admittedly unrealistic) case that every state has legalized sports wagering by 2025, they estimate the industry will generate $15 billion. Clearly, due to legal changes, this industry is primed to explode.

Asset Light: A New, Innovative Strategy

Out of all the different firms vying for a piece of this proverbial sports wagering pie, MGM Resorts International (NYSE: MGM) stands out for their new, forward looking strategy and business deals they are taking to corner the market. MGM, sensing which way the wind is blowing, is currently implementing a strategy to make their company more “asset light,” reduce debt, and return capital to shareholders. This strategy in the long run will make the firm more flexible, and give them the cash to better break into the market in new states as they legalize sports wagering. This has manifested itself twice recently, first on October 15, when MGM agreed to sell two of its properties in Las Vegas, Circus Circus and Bellagio, for $4.3 billion, and again on January 15, when they agreed to sell MGM Grand and Mandalay Bay for $4.6 billion. They will continue to lease and operate the latter three properties. All of the properties were relatively old; all of them were at least 20 years old, and Circus Circus was opened in 1968). This transactions will also more than octuple MGM’s cash on-hand, from $1.23 billion (As of September 30, 2019) to about $10.1 billion before tax and transaction costs. This will be useful as they expand into new opportunities in online gambling.

MGM and the New Reality of Sports Gambling

MGM is quickly moving to increase its market share in new sports betting opportunities. In New Jersey, MGM holds an 8% market share in sports wagering among casino-operating firms. Although this number might seem low, that’s in part because sports gambling in NJ has historically been dominated by Resorts AC, the oldest and most famous Atlantic City Casino. In states other than NJ where MGM is a more recognizable brand than Resorts, MGM will likely be able to get a larger market share.

MGM is also actively moving to increase their market share in the online sports gambling industry. On October 29, MGM and Yahoo Sports announced an official partnership deal for BetMGM, MGM’s online sportsbook, to be integrated into the Yahoo Sports platform. This will come in the form of the ability to place wagers on games directly in the Yahoo sports app, and later on will involve “fantasy-style” gambling that is compatible with Yahoo’s already popular fantasy sports platform. This partnership with Yahoo will greatly increase BetMGM’s exposure to new, potential gamblers, increase accessibility to wagering, and grow revenues as it attracts more people to gambling. Additionally, MGM announced a partnership with Buffalo Wild Wings, the largest sports bar chain in America with over 1,200 locations, in September. This partnership currently includes BetMGM spreads and gaming information being displayed at the bar, and BetMGM is currently testing a program in NJ of giving some exclusive perks to those who use the MGM app inside the bar. Although they did stop short of turning every Buffalo Wild Wings in America into a sportsbook, this will help increase BetMGM’s name recognition and increase revenues and market share directly by incentivizing bar-goers to use MGM’s platform.

Financials (All numbers in millions, except for valuation multiples)

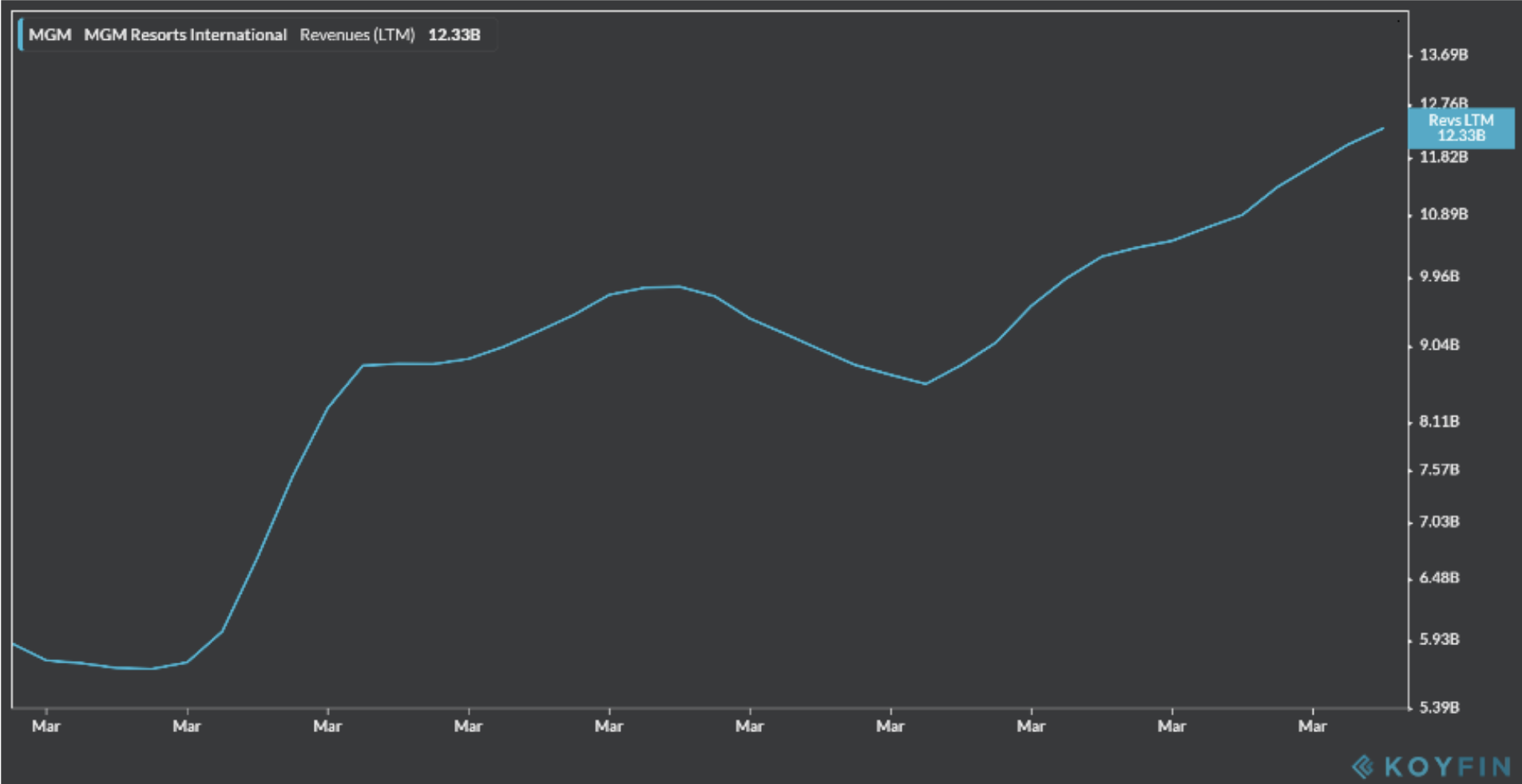

Revenue for the past decade

- MGM posted revenues of $3,314 for Q3 2019, up 2.8% from Q2 and up 9.4% from Q3 last year

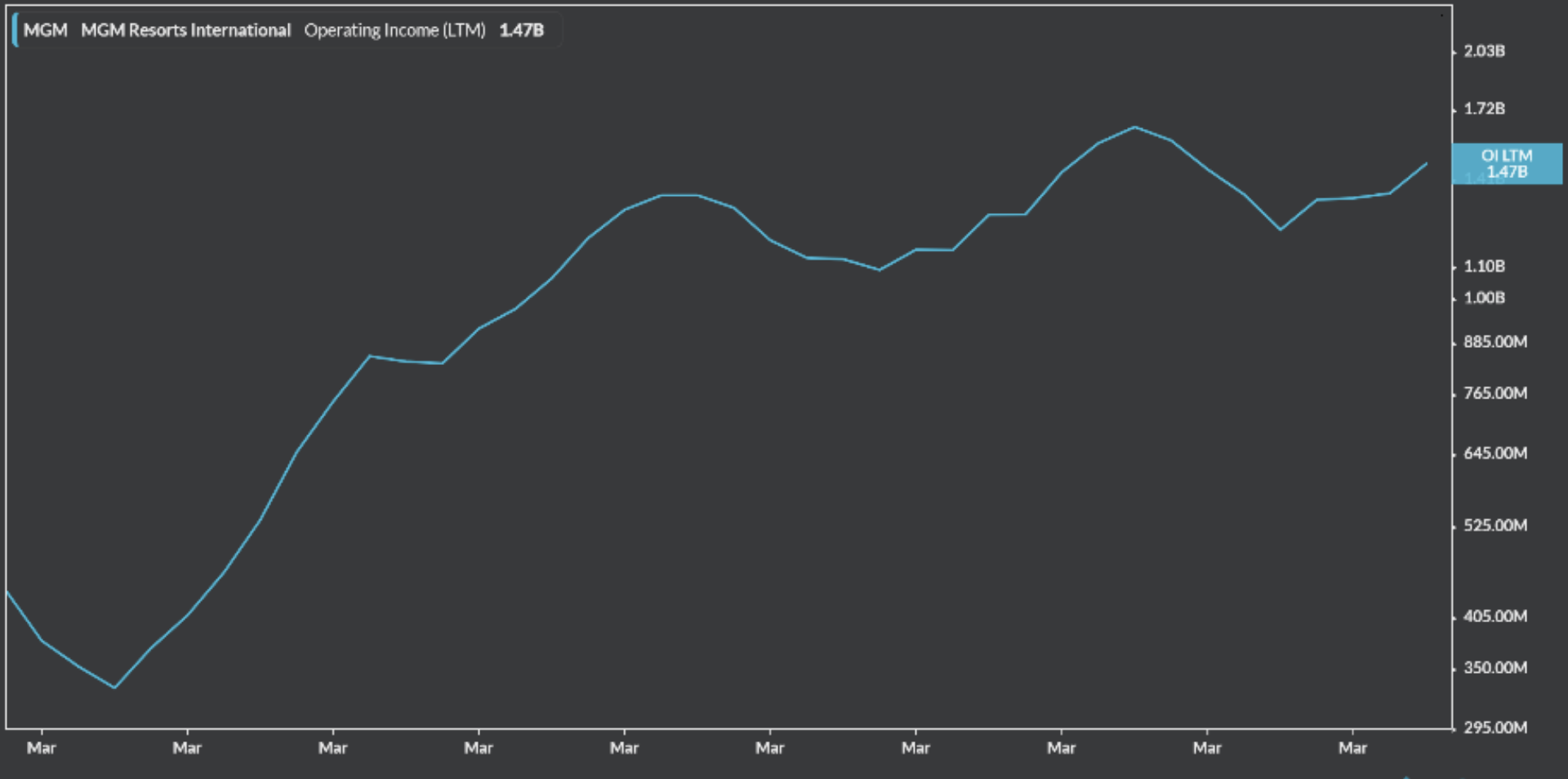

Operating income for the past decade

- Operating income (Non-GAAP) was 452.0 for Q3 2019, up 21.8% from Q2 and up 10.2% from Q3 last year

- EV/EBITDA- 10.5x

- EBITDA margin: 20.69% in September, decreased slightly from 22.38 in August

From these numbers, I see MGM as a company with growing revenues and healthy financials. I also believe that a 10.5 EV/EBITDA multiple undervalues a company with such enormous potential for growth. For comparison, Las Vegas Sands has an EV/EBITDA of 10.9x, and Caesar’s Palace has a multiple of 11.0x. The only real causes for concern in their financials are that their EBITDA margin shrunk somewhat in September and their debt, the former I will cover now and the latter I will cover in the risks section. The slight decrease in EBITDA margin might concern some, however it is still on the higher end of EBITDA margins among its competitors. Part of this is seasonal, as the Q3 EBITDA margin for 2018 was also down from Q2 as Q3 contains some of the slowest months for sports gambling (July and August). For comparison, CZR has an EBITDA margin of 6.23%. The only competitor with a significantly higher EBITDA margin is Las Vegas Sands (NYSE: LVS), with a margin of 33.55%, whose owner has publicly said that he will not enter his company into online gambling in any way, a luddite mindset that I believe will hamper that firm’s growth in the future and allow MGM to take advantage of less competition from one of its biggest rivals in the gambling industry.

Risks (All numbers in millions)

One of the most immediately recognizable risks with MGM is that their interest payments are a large proportion of their operating income (in Q3 it was 47.6% of their operating income, and for FY 2018 it was 57.8%).These numbers might seem alarming, as bankruptcies in the casino industry, such as what happened to Caesars Palace (NASDAQ: CZR) in 2015 are not unheard of. However, MGM is undertaking debt reduction strategies to avoid this possible outcome. Although debt issuance has risen recently, they have also increased debt repayment. For example, in Q2 2019, MGM issued 2,500 in debt, but repaid 2,600. And with the money from the sale of several casinos, I do not foresee their debt being too big of an issue in the future. The sale, at $4,300, amounts to a significant proportion of their $14,943.9 long term debt load at 29%.

Recommendation: Buy

Given MGM’s position in an industry that is primed for significant growth and their healthy financials, I recommend buying equity in the company. I believe that MGM will grow significantly in value as more and more states legalize sports wagering, and they grow their market share in states that already have sports wagering with their new asset light strategy and campaigns to expand accessibility to and recognition of the BetMGM online platform.